On Friday, the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act or CARES Act was officially passed. There is a significant amount of information to digest, so Compass East decided to summarize the CARES Act specifically on how it will provide relief for small businesses.

We won’t focus on other programs like the Relief for Workers Affected by Coronavirus Act providing $1,200 checks to individuals and increases to unemployment insurance that target individuals (but are obviously important as well). We also want to help set timeline expectations based on what we are hearing from SBA approved lenders because it is critical to your scenario planning.

Paycheck Protection Program

$350B 7(a) Loan Program

For companies with less than 50 employees, the Paycheck Protection Program (PPP) is the most beneficial piece of the CARES Act. Administered through SBA lending partners, the PPP authorizes $350 billion for three months of 100% guaranteed 7(a) loans that can be used to cover payroll costs, interest on mortgage payments, rent obligations and utilities.

Covered Period Term: February 15th through June 30th, 2020

Eligible Businesses: Companies with less than 500 employees, including small businesses, qualified non-profits, sole proprietorships, independent contractors and self-employed individuals. Also, businesses in the food service industry with multiple locations qualify as long as there are less than 500 employees at each location. SBA’s affiliate rules are also waived for businesses in the hospitality and restaurant industries, franchises approved on the SBA’s Franchise Directory, and small businesses that receive financing through the Small Business Investment Company program.

Loan Amounts: Determined by multiplying 2.5x the average monthly payroll costs for the last year. The maximum amount is $10 million.

The U.S. Chamber of Commerce has put out a great PDF on how to calculate your payroll costs.

Use Cases: Companies can use funds for payroll costs, interest payments on any mortgage obligations or other debt obligations incurred before February 15, 2020 (but not any payments or prepayments of principal), rent and utilities. Payroll costs include compensation to employees, payments for vacation, parental, family, medical or sick leave, severance, health benefits, retirement benefits, and state and local employment taxes. Money cannot be used to compensate employees with $100k+ in annual salary.

7(a) Traditional Loan Changes – The Paycheck Protection program will be administered through SBA approved lenders, with the same process as traditional SBA 7(a) loans. The legislation makes requirement changes to traditional 7(a) loans:

- No personal guarantee will be required

- No collateral needs to be pledged

- Waives requirement for businesses to show that it cannot obtain credit elsewhere

The borrower must certify that the loan is necessary due to economic issues, that they will use the funds to retain workers, maintain payroll, or make lease, mortgage, and utility payments; and that they are not receiving duplicative funds for the same uses.

Note: “Duplicative funds” specifically calls out the SBA Economic Injury Disaster Loans (EIDL). The consensus in talking to SBA Lenders is to go ahead and apply both the EIDL’s through the SBA website and 7(a) loans. While you cannot use funds from both the EIDL and 7(a) loans made through the PPP for COVID-19 relief, the final CARES Act bill allows you to refinance an EDIL loan into a PPP loan as long as it was issued after January 31st, 2020. You just can’t use both loans simultaneously for the same purpose. If you are approved for Tornado specific disaster relief in Nashville, you could use both the Tornado EIDL loans and COVID-19 loans from the Paycheck Protection Program (PPP), however.

Deferment of Payments: Payments of principal, interest, and fees will be deferred for at least 6 months, but not more than 1 year.

Interest Rates and Fees: Interest rates are capped at 4%. The SBA will not collect any yearly or guarantee fees for the loan, and all prepayment penalties are waived. The SBA has no recourse against any borrower for non-payment of the loan, except where the borrower has used the loan proceeds for a non-allowable purpose.

Loan Forgiveness: Borrowers are eligible for loan forgiveness for 8 weeks from the origination date for payments made on payroll costs, rent payments, utility payments, and mortgage payments. This is significant for the near term.

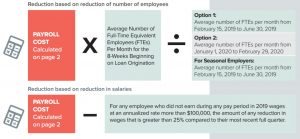

Loan forgiveness, however, is reduced based on a reduction of employees or cut to more than 25% of their salaries. To calculate reductions forgiveness, the U.S. Chamber of Commerce provides a great calculator to figure out what that reduction looks like:

If employees are laid off, furloughed, or have had their salaries reduced by more than 25%, full loan forgiveness can be provided if the employer rehires employees or increases wages back to their previous amounts by June 30th, 2020.

Due Diligence: Prior to the extension of any loan under the PPP, the program lender must evaluate the eligibility of each borrower that applies for a covered loan. The lender will consider that the applicant:

- Was in operation on February 15, 2020; and

- Had employees for whom the borrower paid salaries and payroll taxes, or paid independent contractors, as reported on a Form 1099-MISC.

Documentation: The SBA will be providing additional guidance to lenders over the next few weeks but from the initial documentation guidance you will be required to provide:

- Documentation verifying the number of full-time equivalent employees on payroll and pay rates for pre- and post-covered periods, including payroll tax filings, reported to the IRS and state income, payroll, and unemployment insurance filings;

- Documentation such as canceled checks verifying mortgage interest, lease, and utility payments;

- Certification from a representative of the recipient that (a) the documentation presented is true and correct, and (b) the amount for which forgiveness is requested was used to retain employees, make interest payments on a covered mortgage obligation, make payments on a covered rent obligation or make covered utility payments; and

- Any other documentation the SBA deems necessary.

Applications: Talking to SBA approved lenders, additional guidance on applications and process will take 1-3 weeks once the bill is approved. Ideally, these applications are not overly intensive as the SBA is also empowered to approve applicants for small-dollar loans solely on the basis of their credit score or “alternative appropriate methods to determine an applicant’s ability to repay.” This is all TBD however upon passage of the bill.

Timeline: Here is potentially a major issue with the PPP as we’re talking to lenders on the timeline. Now that the PPP has been signed into law, SBA lenders are hopeful that they receive additional guidance by April 1st through 3rd. However, multiple SBA lenders have confirmed more realistic timeline estimates of 3-6 weeks from March 28th to get applications live and processed. So checks in hand could potentially take longer. This certainly affects near term cash flows for many small businesses given it could be 6-8 weeks before relief actually arrives.

Current SBA Loan Holders – Six Month Forgiveness

There is some additional good news for companies that already have specific SBA loans on the books. Specifically pertaining to loans guaranteed by the SBA Administrator under the:

- The SBA Business Loan Program (including the Community Advantage Pilot Program, but excluding the new payroll loan program established under Section 1102); or

- Title V of the Small Business Investment Act; or

- Made by an intermediary to a small business concern using loans or grants received under the SBA’s Microloan Program.

The bill “encourages lenders to provide payment deferments, when appropriate, and to extend the maturity of covered loans, so as to avoid balloon payments or any requirement for increases in debt payments resulting from deferments provided by lenders” during the COVID-19-declared emergency.

More beneficially, the bill says the Administrator must pay (and relieve the borrower of any obligation to pay) the principal, interest, and any associated fees owed in a regular servicing status:

- For loans made before this bill is enacted not on deferment, for the six-month period beginning with the next payment due;

- For loans made before this bill is enacted that are on deferment, for the six-month period beginning with the next payment due after deferment; and

- For loans made within six months of enactment of this bill, for six months after the first payment is due.

Essentially if you have an existing SBA loan from one of the listed programs above, the SBA will pay the principal, interest, and associated fees on certain pre-existing SBA loans for 6 months. Specifics are unclear this second, but clearly talk to your existing SBA lender!

Expansion of Disaster Relief Loan Program, $10k Advance Grants

There were also additional changes to the Economic Injury Disaster Relief Loans (EIDL) loans that were summarized in our previous post. The CARES Act waives specific requirements for the SBA Disaster Loan Program for COVID-19:

- Waives rules related to personal guarantees on advances and loans of $200,000 or less for all applicants;

- Waives the “1 year in business prior to the disaster” requirement (except the business must have been in operation on January 31, 2020);

- Waives the requirement that an applicant be unable to find credit elsewhere; and

- Allows lenders to approve applicants based solely on credit scores (no tax return submission required) or “alternative appropriate methods to determine an applicant’s ability to repay.”

Also, the CARES Act provides applicants of EIDL’s an opportunity to request an emergency advance from the Administrator of up to $10,000, which does not have to be repaid, even if the loan application is later denied. The Administrator is charged with verifying an applicant’s eligibility by accepting a “self-certification.” Advances are to be awarded within three days of an application. Businesses can use this grant for payroll, sick leave, debt payments, mortgage and rent payments, and increased supply chain costs. If approved for a Disaster Loan, the $10k will just be subtracted from the awarded amount and have to be paid back.

Tax Credits, Payment Delays and Other Benefits

Employee Retention Credit

The CARES Act provides eligible employers – including tax-exempt organizations but not governmental entities – a refundable credit against payroll tax (Social Security and Railroad Retirement) liability equal to 50% of the first $10,000 in wages per employee (including value of health plan benefits). Eligible employers must have carried on a trade or business during 2020 and satisfy one of two tests:

- Have business operations fully or partially suspended operations due to orders from a governmental entity limiting commerce, travel, or group meetings; or

- Experience a year-over-year (comparing calendar quarters) reduction in gross receipts of at least 50% – until gross receipts exceed 80% year-over-year.

For employers with more than 100 full-time employees, only employees who are currently not providing services for the employer due to COVID-19 causes are eligible for the credit. The employee retention credit is effective for wages paid after March 12, 2020, and before January 1, 2021.

Delay of Employer Payroll Taxes

The CARES Act postpones the due date for depositing employer payroll taxes and 50% of self-employment taxes related to Social Security and Railroad Retirement and attributable to wages paid during 2020. The deferred amounts would be payable over the next two years – half due December 31, 2021, and half due December 31, 2022.

Treatment of Losses

Certain changes to the loss provisions made by the Tax Cuts and Jobs Act (TCJA) are suspended in an effort to allow companies to utilize greater losses as well as to claim refunds for certain losses. Specifically, the CARES Act:

- Suspends the TCJA’s 80% of taxable income limit on net operating loss (NOL) carryovers for three years, so that the limit would not apply to tax years beginning in 2018, 2019, and 2020;

- Allows NOLs arising in 2018, 2019, and 2020 to be carried back five years; and

- Suspends the limitations on excess farm losses and on the use of a pass-through business’ losses against non-business income for three years, so that the limits would not apply to tax years beginning in 2018, 2019, and 2020.

Limitation on Business Interest Expense

The CARES Act would temporarily increase the limitation on interest deductions imposed by the TCJA. Specifically, the Act would increase the 30% of adjusted taxable income (ATI) threshold to 50% of ATI, for tax years beginning in 2019 and 2020. (Special tax year 2019 rules would apply to partnerships.) It would also allow a taxpayer to elect to use tax year 2019 ATI in lieu of tax year 2020 ATI for the purpose of calculating its tax year 2020 limitation.

Please reach out with any additional questions!

John Lanahan

Director Of Financial Strategy

john.lanahan@compasseast.com

Sources:

Bill Text – https://www.documentcloud.org/documents/6819206-CARES-ACT-FINAL-TEXT.html

US Chamber of Commerce – https://www.uschamber.com/sites/default/files/023595_comm_corona_virus_smallbiz_loan_final.pdf

Other summaries:

https://www.venable.com/insights/publications/2020/03/the-cares-act-what-you-need-to-know-about#Borrower