When your small business’s finance team structure isn’t set up well, it can cost you—big time. Overpaying for routine tasks, relying on inaccurate financial data, and suffering from poor strategic alignment are common outcomes that can all hinder your growth and cause you to miss valuable opportunities.

The good news? Getting the right structure in place doesn’t have to mean hiring a big team of full-time employees. That might work for large companies, but for early-stage and smaller businesses, it’s not realistic—or necessary.

Building a solid finance and accounting team structure is all about strategically assessing which roles are crucial for your business and, more importantly, how to fill them in the best way, typically with fractional resources.

When your finance department is structured properly, everything clicks into place. Bills get paid on time, reports are accurate, and decisions are informed by reliable data. That leaves you free to focus on what really matters: growing your business.

Traditional Finance and Accounting Department Structure

Small companies tend to make two mistakes when structuring their finance and accounting teams: hiring too senior or too junior.

For instance, they may hire a finance leader like a CFO, thinking they need someone highly strategic to handle everything from financial strategy to day-to-day accounting. But a CFO’s true value lies in overseeing big-picture financial initiatives like setting strategies and driving growth—not managing routine tasks like reconciling QuickBooks or processing invoices.

This approach costs companies in more ways than one. First, they end up overpaying for routine tasks that could be handled by a more junior (i.e., less expensive) team member. Second, the CFO’s time is diverted from important strategic work, making it difficult for them to focus on growth or long-term financial planning.

On the other end of the spectrum, some businesses rely too long on junior resources like bookkeepers, expecting them to manage tasks beyond their expertise, such as financial reporting and budgeting. The risk? Inaccurate data and flawed financial strategies.

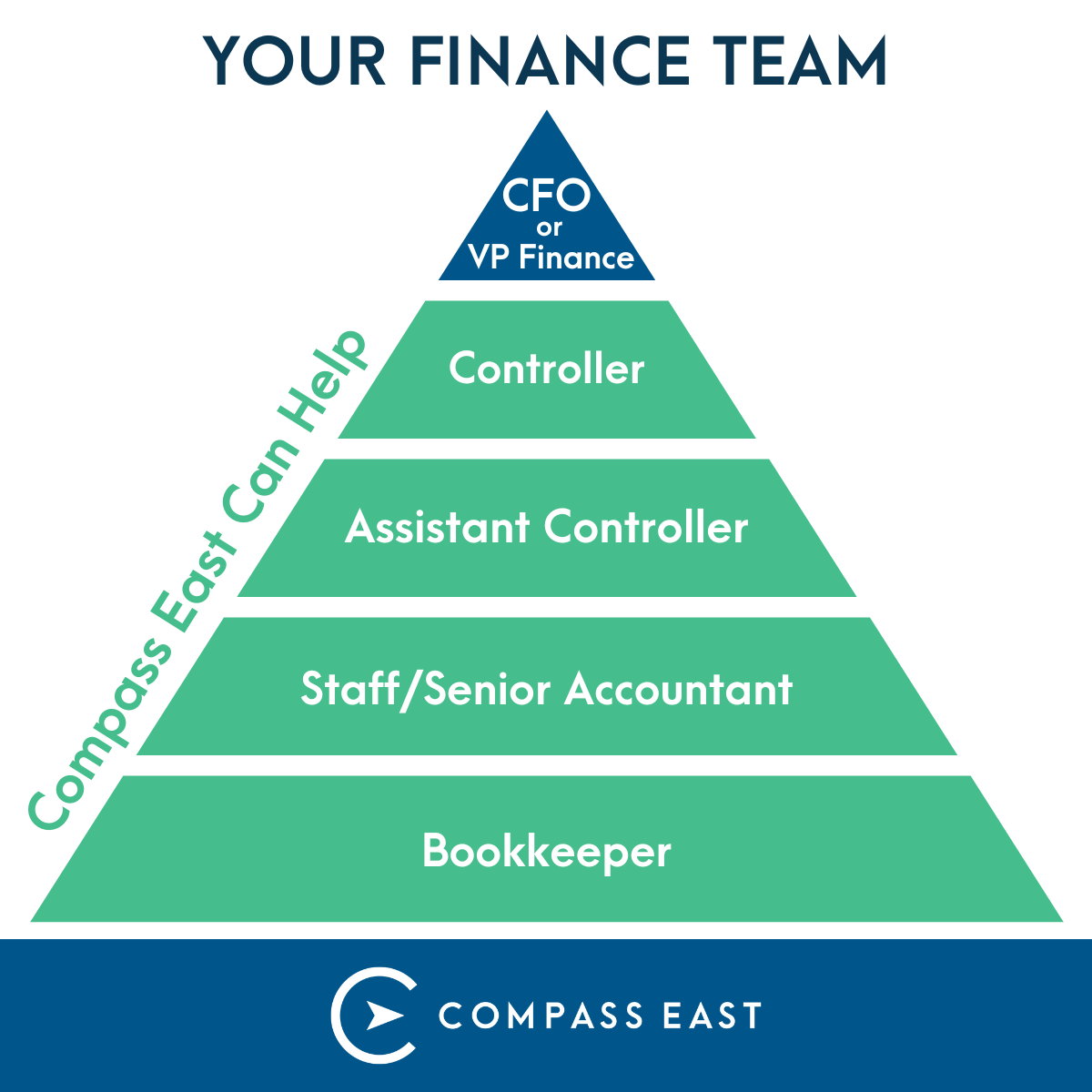

The reality is that no single skill set can cover all your business’s financial needs, even if you’re a small company. You need a mix of expertise, from bookkeeping to financial leadership, to handle both day-to-day operations and big-picture strategy. Let’s break down these essential roles and why they’re so important.

Bookkeeper

Median annual salary: $44,491

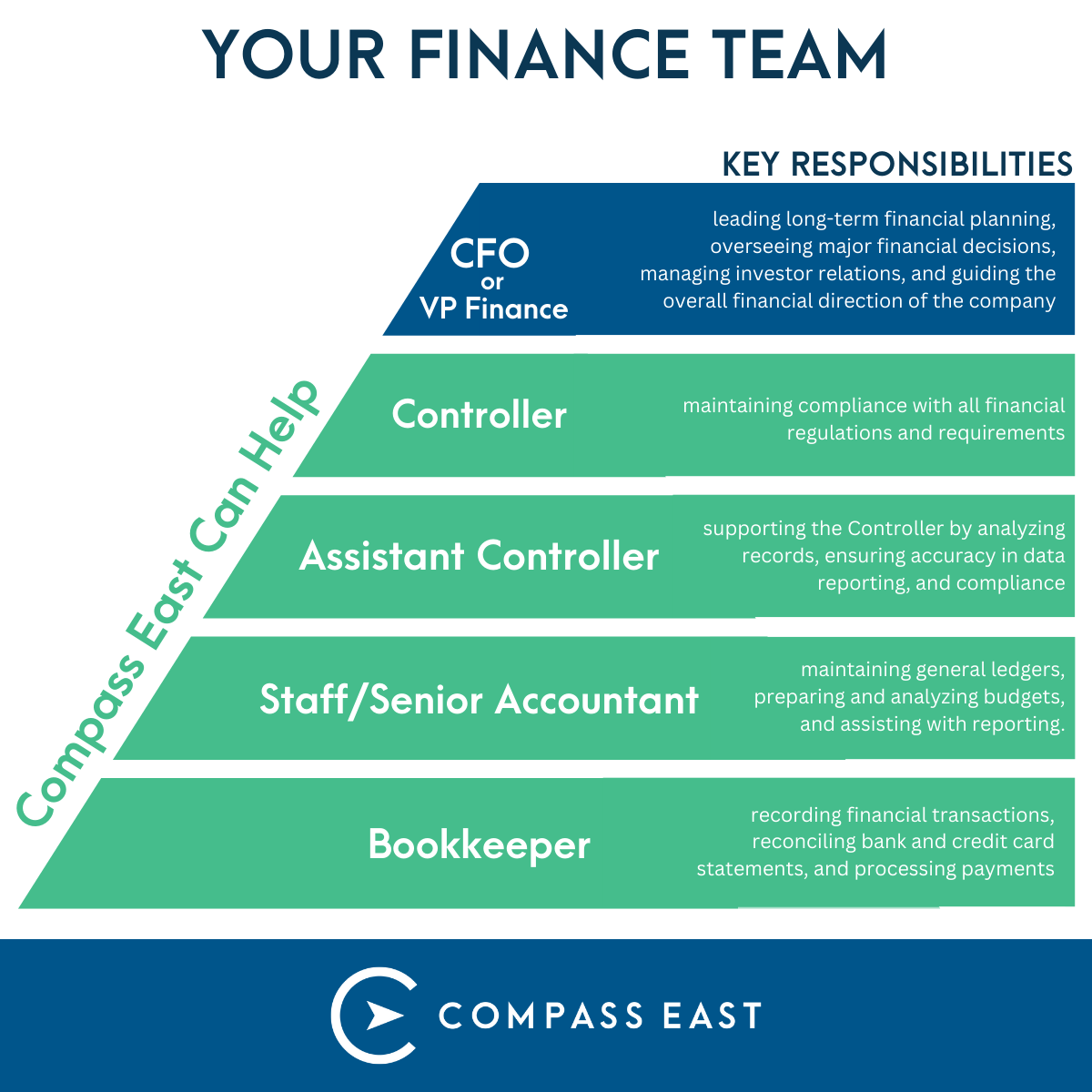

A bookkeeper plays a crucial role in maintaining the financial health of a business by tracking the flow of money in and out. Their key responsibilities include recording financial transactions, reconciling bank and credit card statements, and processing payments. They are also responsible for entering sales, expenses, and other transactions into the company’s system to ensure financial records are up to date and accurate. Bookkeepers are often the point of contact for collecting receipts and expense reports from employees.

Bookkeepers should be adept at catching small, hidden errors in budgets or invoices. They must be able to quickly shift focus as they move between different financial tasks, such as conducting bank reconciliations or processing payments.

While bookkeepers are essential for managing daily financial operations, larger or more complex accounting tasks (i.e., preparing financial statements, conducting audits) should be handled by a Certified Public Accountant (CPA), who brings a higher level of expertise.

Senior and Staff Accountants

Median annual salary: $73,913

A senior or staff accountant holds a key role within the finance team structure, typically positioned between entry-level bookkeepers and higher-level financial managers like a controller or CFO. Depending on the size and needs of the company, some businesses may only have a staff accountant. Others might have both a senior and a staff accountant, with the senior overseeing the work of the staff accountant.

In either case, these roles are responsible for more complex financial tasks than a bookkeeper. Their duties include maintaining general ledgers, preparing and analyzing budgets, and assisting with financial reporting. Under the supervision of a manager, a staff or senior accountant can handle compliance reporting tasks, such as sales tax and payroll audit preparation, once the processes are clearly defined and established.

Unlike bookkeepers, who primarily focus on day-to-day transactions and data entry, staff and senior accountants take a more analytical approach. They examine financial trends, identify discrepancies, and offer insights that support strategic decision-making. While they can manage certain tax issues, more advanced or regulated tasks are typically referred to a CPA.

Controller

Median annual salary: can range from $150,000 to $250,000, depending on company size

A controller is a senior-level position, typically reporting to the CFO or VP of Finance, who is responsible for overseeing a business’s entire accounting operations. Their role is to plan and direct all accounting functions, consolidating financial data to ensure the company’s financials are accurately represented.

A primary responsibility of the controller is maintaining compliance with all financial regulations and requirements, which makes them an essential player in guaranteeing the integrity of a business’s financial practices.

Controllers are the implementers within the finance department. They establish the systems, processes, and controls necessary to scale the company’s financial operations as it grows. They play a pivotal role in managing the audit process and developing departmental budgets to ensure the financial department operates efficiently.

In fast-growing companies, controllers contribute significantly to financial reporting, forecasting, and strategic planning to help the business make informed decisions that support growth and sustainability.

Finance Leader

Median annual salary: can range from $200,000 to $360,000, depending on company size

In larger organizations, it’s common to have both a CFO and a VP of Finance to handle distinct aspects of the company’s financial management.

A CFO typically focuses on big-picture strategy—leading long-term financial planning, overseeing major financial decisions, managing investor relations, and guiding the overall financial direction of the company. As part of the executive team, the CFO collaborates with the CEO and COO to steer the company’s financial trajectory.

A VP of Finance usually handles more of the day-to-day operational responsibilities. This includes ensuring accurate financial reporting, managing the finance team, overseeing cashflow, and maintaining compliance with financial regulations.

In companies with both positions, the VP of Finance supports the CFO by handling these operational responsibilities, allowing the CFO to focus on strategy and long-term planning.

However, in smaller companies, it’s more common to have just one finance leader who may hold the title of CFO, VP of Finance, or a combination of both. This individual must balance strategic and operational duties, taking on both long-term financial planning and day-to-day tasks like budgeting, financial reporting, and compliance.

By combining these responsibilities, the finance leader ensures the company’s immediate financial needs are met while positioning it for future growth.

Other Roles

Financial analysts play a vital behind-the-scenes role in many organizations, though they’re not always a core part of smaller companies’ finance departments. These individuals are responsible for building financial models and forecasts for the finance leader and creating capital budgets for projects.

While the CFO and VP of Finance typically bring years of experience to the table, financial analysts are often earlier in their careers. As a result, they tend to do the heavy lifting involved in adjusting and fine-tuning financial models.

It’s also important to mention the role of Certified Public Accountants (CPAs). Although external to the company, CPAs play a critical role in financial decision-making. They are typically responsible for overseeing tax matters, ensuring compliance with accounting standards, and providing expertise on more complex financial issues. A company may consult a CPA for tasks like auditing or preparing financial statements, making them an essential partner in the finance ecosystem.

Compass East Provides Scalable Financial Solutions

Building an effective finance team isn’t about having a full-time staff for every role—it’s about having the right skills in place at the right time. Many small businesses don’t need full-time employees in every position. Instead, starting with just a few hours a week from a bookkeeper, accountant, or controller can keep things running smoothly—and you can increase your resources as your business grows.

That’s where Compass East steps in. We understand that you don’t need a massive team to get expert-level support. Our approach prioritizes giving you access to specialized, part-time resources at every level—whether it’s a bookkeeper to handle day-to-day transactions, a senior accountant to ensure accuracy and compliance, or a controller to help implement the CFO’s vision.

We’re most effective when you already have a financial leader, like a CFO or VP of Finance, who can focus on the big picture. From there, we supplement your team with the right mix of resources, ensuring your finance function is scalable and efficient. The result? You can focus on growth, knowing your financial foundation is solid and ready to support your next move.

Deep strategic expertise

Compass East understands what an efficient finance team should look like—it’s our business model, after all. We’re experts in financial operations, and we’ll help you create a streamlined, optimized finance function that fits your business.

Streamlined communication

We offer a single point of contact for all your financial needs. We assign someone—typically at the assistant controller level—to manage your account and communicate directly with you. This single point of contact simplifies communication for whoever is in charge of your finances, whether it’s a CFO, VP of Finance, COO, or CEO. No more juggling multiple contacts—just one go-to person helping everything run smoothly.

Ready to optimize your finance team structure? Contact Compass East today and discover how we can help you build an efficient, high-performing finance function that supports your business goals.