Running a business is tough. Whether it’s focusing on your product, internal operations, or most importantly, your customers, prioritizing the development of proper finance and accounting workflows is likely on the low end of the priority list. Over time, however, neglecting these crucial financial operations early on will create inefficiencies, fundraising challenges, and blind spots in your business over time.

So what do we mean when we talk about “scalable financial operations”? Scalable financial operations are the combination of software automation, proper workflows, and processes, which create an environment that allows for accurate financial reporting and efficient back-office activities. Over the coming weeks, we’ll outline a number of the basic components in building a scalable financial operation in a series of blog posts:

1. Finance and Accounting Technology Ecosystem

2. Process and Workflows

3. Closing Books

4. Budgeting and Forecasting

Today, we are highlighting the finance and accounting software systems that create a proper ecosystem:

Finance and Accounting Technology Ecosystem

The latest suite of cloud-based accounting technology has created an inexpensive, flexible solution to many of the bulky or stagnant systems of the past. At Compass East, we establish an ecosystem of accounting software designed specifically for our client’s needs and leverage the latest technologies when major improvements have been made. Our client’s ecosystem is designed to fit industry, business model, and upgrade current operations in place. While the list is constantly evolving, here’s a current snapshot of the various systems that we utilize today:

General Ledger systems

Core to any scalable ecosystem, the general ledger system acts as the base of your financial operations by storing, managing, and balancing the transactions and information that govern your company’s finances. Quickbooks Online and Xero are the two major systems we use to establish the base general ledger. These systems provide native API integrations with many other critical software allowing for flexibility in design.

They are also cost effective, constantly adding new features and provide an opportunity for flexible integrations that create a similar functionality and insights as full-scale enterprise solutions for a fraction of the price. Starting with Quickbooks Online or Xero for your base general ledger gives you flexibility as the company grows versus being locked into a single solution over time.

Invoicing and Bill Pay

Modernizing your accounts payable system with Bill.com can relieve the administrative headache of paying bills and sending invoices manually. The system will create significant efficiencies in vendor management, AP processing and segregation of duties. Bill.com can establish necessary approval structures, such as a 2-approver structure, for example, for all bills over a certain dollar amount. Also, these systems establish proper accounts receivable and payable, which enable accrual-based accounting and reporting, providing a more accurate representation of the business

With Bill.com, we see a significant reduction in paper bills and checks, a fast approval process from anywhere on any device, and the establishment of a digital audit trail. By leveraging these efficiency improvements, cloud-based AP systems make bill pay and invoicing seamless, freeing up time for more strategic decision making versus a manual processing timesuck.

Expense Management and Reimbursement

Expense Management and Reimbursement is another area that typically causes our client’s headaches. Leveraging a cloud based and mobile system allows our client’s employees/contractors to tag transactions to their appropriate category and route for electronic approval, saving significant time in communication and receipt collection. Most of all, making managing expenses easy for your employees means that they are much more likely to file their expense reports. Our recommendation on an expense management solution depends on your company’s preference on issuing corporate cards versus reimbursing employee’s personal cards. The two solutions we utilize are Expensify and Divvy.

For a reimbursement approach, Expensify’s simple solution for recording receipts occurs through their mobile app’s camera feature, allows employees to take a picture of a receipt which automatically records the name and amount on the receipt. Expensify’s app automatically integrates with financial institutions, credit cards or other payment modes, providing a seamless process for tracking credit card transactions and submission of expense reports.

Divvy approaches expense management with corporate and purchase cards, providing a virtual purchasing card to employees. The biggest difference between traditional purchasing cards and Divvy is the ability to provide full control over the allocation of available funds by creating limits to each individual’s card. The cards can be turned off/on as needed and specific budgets may be set up for advanced expense budgeting and management.

Both systems are extremely useful and cost-effective, and can help manage expense budgets that were previously tedious and time-consuming.

Employee Onboarding and Payroll Administration

Managing new employee onboarding and payroll is a pain. Moreover, depending on the size of your organization, you’re likely looking at a payroll service or a professional employer organization (PEO).

Gusto can provide technology forward option for payroll administration and employee management. Via API’s, Gusto works seamlessly as an integrated HR platform, administering payroll while providing optionality for health insurance, 401(k), workers’ comp, time tracking, and PTO management. Furthermore, through electronic onboarding of employees and ongoing compliance, Gusto automatically files payroll taxes with the right government agencies every time you run payroll. Additionally, Gusto provides superior payroll tax management and remittance capabilities to ensure payments are not missed.

KPI reporting

The ultimate goal of building a scalable accounting infrastructure is to provide accurate financials in a consistent manner. Only until you trust your financial reports, can you then start to develop forward looking projections and track key performance indicators (KPI’s).

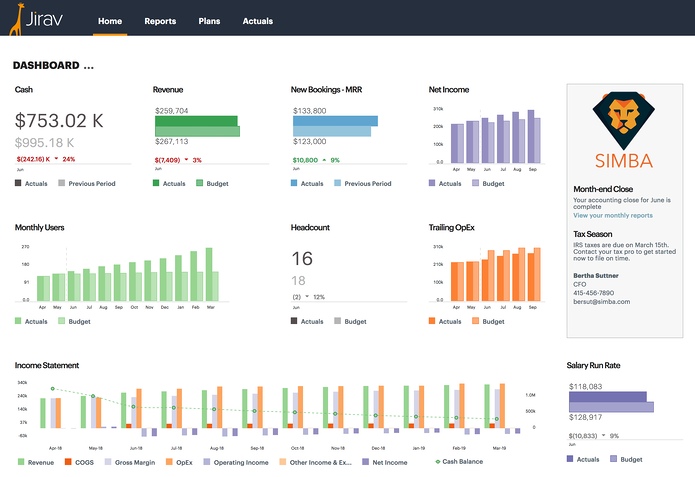

With systems like Jirav and Futurli that easily integrate with the rest of our ecosystem, this is the final piece to the puzzle. The objective of the KPIs is to quickly assess your company’s performance in relation to its goals, benchmarks, and market. After the KPIs are identified, a KPI dashboard tool can be implemented to provide a visual presentation of these metrics for management and its stakeholders on a monthly basis, the following is an example from Jirav:

Overview

Establishing scalable financial operations from the ground up enables high quality services and accurate financial reporting and projections. When you have a strong financial foundation, and streamlined operations, you can trust your data and enable forward looking planning and projections. At Compass East, our goal is to empower entrepreneurs with the confidence to focus on what matters most, the delivery of exceptional products and services in their business.