Picture this scenario:

You’re sitting in a board meeting. The conversation shifts to financial performance, and the pressure in the room rises. You share your data, but something isn’t quite adding up. The board members start questioning your numbers. They ask for reports you don’t have. It’s not a good look. Frustration builds as they push for clarity—and you can’t deliver what they want.

Before you know it, someone suggests it’s time for an upgrade: a more robust accounting system that can provide deeper insights and clearer, better reporting. Surely, QuickBooks Online (QBO) isn’t sophisticated enough for a company at your level, the board members agree.

Let’s stop right there for a moment.

It’s tempting to think that switching away from QuickBooks Online to a “more robust” platform like an ERP (enterprise resource planning) system is the solution you need. Your board members, private equity investors, or executive team are right to want accurate financial data and comprehensive reporting. But at Compass East, we’ve seen scenarios like this one play out time and time again—and the truth is, the problem often isn’t the software.

As a QuickBooks Certified ProAdvisor, Compass East has extensive experience helping small and medium-sized businesses leverage QBO for growth. We can help you determine when it makes sense to stay with QBO, how to optimize your current setup with the right configurations and support, and when it’s time to upgrade.

The Actual Problem: It’s Probably Not the Software

QBO and other double-entry accounting systems are fully capable of maintaining accurate financials for small and medium-size businesses. In most cases, errors occur not because the software is lacking, but because of process gaps, bad data, or people using the system incorrectly.

When stakeholders lack the full picture, it’s easy for them to attribute financial reporting issues to software limitations. But here’s the truth: migrating to a new system without fixing the underlying issues will only create more problems. The same errors will persist—but in a more expensive and complex environment.

QuickBooks Online Remains a Market Leader

With an impressive 81% market share in the accounting software market, Intuit’s QuickBooks Online has evolved into one of the most robust and flexible accounting platforms for small and medium-sized businesses. Over the years, it has adopted features from innovative competitors like Xero to become a dominant force in cloud-based accounting.

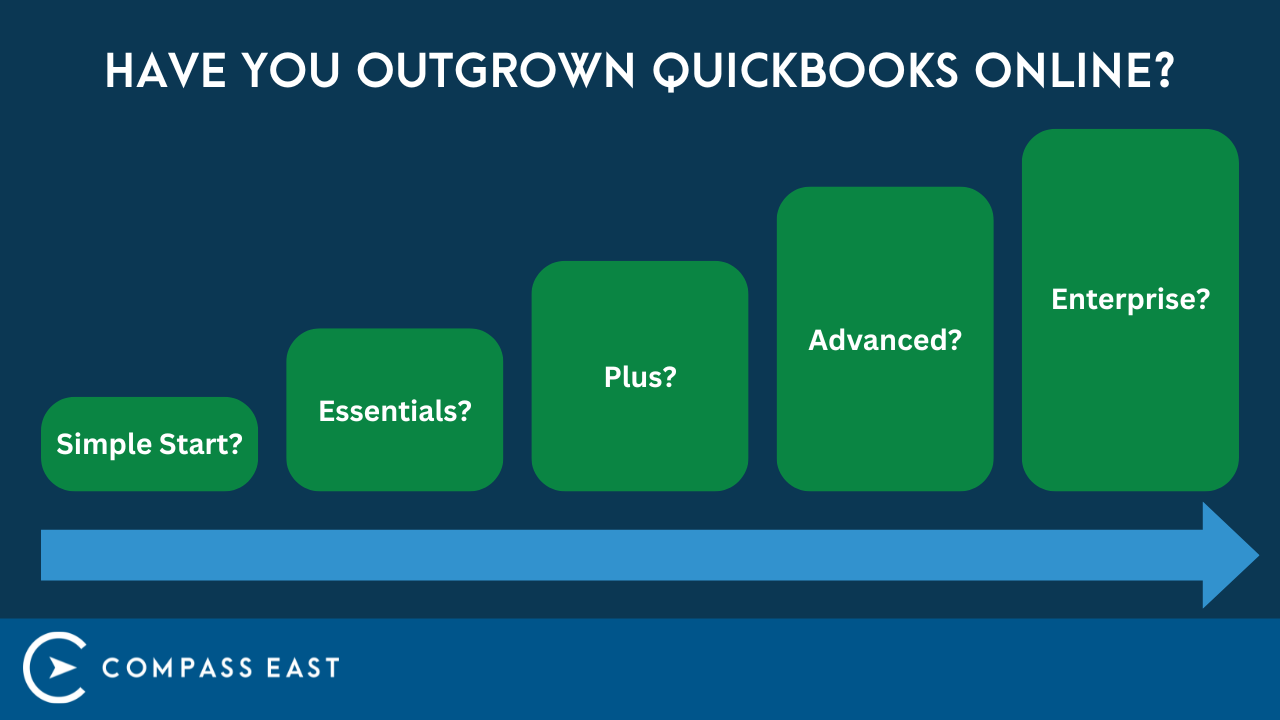

QBO has multiple tiers—Simple Start, Essentials, Plus, Advanced, and the newly released Enterprise level—to offer scalable solutions for growing companies at every size.

The Enterprise tier represents a significant shift for QBO. Its ERP-level functionality allows companies to stay with QBO instead of transitioning to an ERP system. Intuit’s message is clear: “You don’t have to leave us—just upgrade instead.”

At Compass East, we’re actively exploring all the ins and outs of QBO Enterprise to ensure we can fully support our clients in leveraging its capabilities. We’ll be sharing more insights soon, so stay tuned for updates as we dive deeper into how Enterprise can support your business’s growth and success.

The Real Costs of Switching to an ERP System

ERP systems promise to unify business processes—accounting, inventory management, CRM, and more—into a single platform. While these solutions are indeed powerful, they come with challenges that many small and medium-sized businesses underestimate:

- High costs: An ERP system can cost $20,000–$25,000 per year, compared to QBO’s much more affordable pricing. (The Advanced tier is $235 per month, although keep in mind that you might be paying for other tools, such as a CRM system, separately).

- Complicated implementation: ERP systems require significant customization to align with specific business processes. Implementation involves configuring multiple modules and ensuring they work seamlessly together, which often demands specialized expertise from external consultants and careful planning.

- Training requirements: Adopting an ERP system often involves extensive training to ensure teams can use it effectively. During the transition, businesses must run both old and new systems in parallel, temporarily doubling workloads.

It’s not uncommon for small and medium-sized businesses to find ERP systems overwhelming. We’ve even seen clients revert back to QBO after realizing that their financial issues were not related to software in the first place and that the ERP system was too complex for their needs.

Maximizing QuickBooks Online with the Right Integrations

Fortunately, QBO offers an ecosystem of third-party tools that can address specific needs without requiring a complete system switch. For example:

- BILL extends QBO’s accounts payable functionality.

- Financial modeling tools like Jirav and Fathom integrate seamlessly for advanced forecasting.

- Revenue recognition tools like Flowrev and REVLOCK help SaaS companies automate financial compliance.

Tools like these allow businesses to customize their QBO setup without needing an entire ERP system. With this flexibility, companies can select the best software for each function, creating a solution tailored to their needs [link to To Integrate or Not to Integrate: Accounting Software Integration Considerations].

That said, it’s important to choose integrations that enhance QBO’s functionality without adding unnecessary complexity. Too many disconnected tools or poorly aligned add-ons can create confusion, disrupt workflows, and lead to data inconsistencies. The key is to implement integrations that complement your existing processes and make financial management easier—not more complicated.

When It’s Time to Upgrade to an ERP System

While QBO is a powerful tool, there are cases when transitioning to an ERP system makes sense—especially for companies with complex inventory management or sophisticated reporting requirements. ERP systems excel at:

- Inventory management: QBO can handle basic inventory, but ERP systems offer deeper functionality for businesses with extensive product lines.

- Advanced user controls: ERP systems enable more granular control over user access, which can be critical for large organizations with multiple departments.

- Fully integrated operations: An ERP integrates CRM, payroll, and other systems into one source of truth, enabling real-time tracking and cross-departmental reporting.

However, service-based companies and those with straightforward financial needs often gain little from an ERP’s complexity. Staying with QBO and enhancing it with integrations is usually the better option for these businesses.

How to prepare if a switch is necessary: quick tips

If moving to an ERP system is the right choice, preparation is critical to success. Here are some quick tips for ensuring a smooth transition:

- Create a detailed implementation plan with timelines and milestones.

- Run systems in parallel for at least two months to ensure consistency between the old and new systems.

- Assign champions from each department to oversee the transition and training.

- Ensure legacy data is accurate and ready to transfer to the new system.

- Invest in employee training to minimize disruptions during the transition.

Implementation almost always takes longer than expected. Plan accordingly, and ensure internal champions are available to lead the change.

Compass East Helps Businesses Optimize QuickBooks Online

Before deciding to switch systems, businesses should evaluate whether they are using QBO to its full potential. If your current QBO setup isn’t meeting expectations, the issue may be configuration—not capability. Compass East can help you evaluate your setup and ensure you’re using the best tools for your business.

As a QuickBooks Certified ProAdvisor, Compass East can work closely with you to:

- Identify the right QBO tier to match your business needs.

- Configure QBO for optimal performance and reporting.

- Recommend third-party integrations to extend QBO’s functionality.

- Guide you through system transitions, whether upgrading within QBO or moving to an ERP system.

QBO’s ease of use and scalability make it an ideal option for most small and medium-sized businesses. With our support, you can optimize your current system and avoid the stress of an unnecessary transition.

Software Is Just a Tool

Switching to an ERP system may seem like the next logical step for a growing business, but it often creates more problems than it solves. In many cases, companies only need better processes or configurations within QBO—not an entirely new system.

The best starting point is to evaluate your current setup. If you’re not getting the results you need from QBO, it might be time to explore new QBO tiers or add targeted integrations. Compass East can help you make the most of your current tools and determine whether an upgrade is truly necessary.

Remember—software is just a tool. Without the right people and processes, no system will solve your problems—and upgrading will only create bigger headaches.

Ready to get the most out of QuickBooks Online? Contact Compass East today to discuss your setup, explore integrations, and determine the best path forward for your business.