In our last blog post, we asked, how much does it cost you to acquire customers? Understanding how to calculate Customer Acquisition Costs is incredibly important, but even more important is understanding how well you monetize and keep customers around. This is where Customer Lifetime Value comes into play.

Lifetime Value (LTV) is the amount of revenue a single customer generates over the lifetime of their engagement. LTV defines what a customer is “worth” and subsequently impacts all aspects of the business.

Is my business model profitable? Do I need to improve customer service to prevent churn? How can I retain customers for longer periods of time? How much money can I budget for marketing? Do I need to move upmarket to capture higher paying customers?

LTV helps answer all of these strategic questions.

Five Steps to Calculate LTV

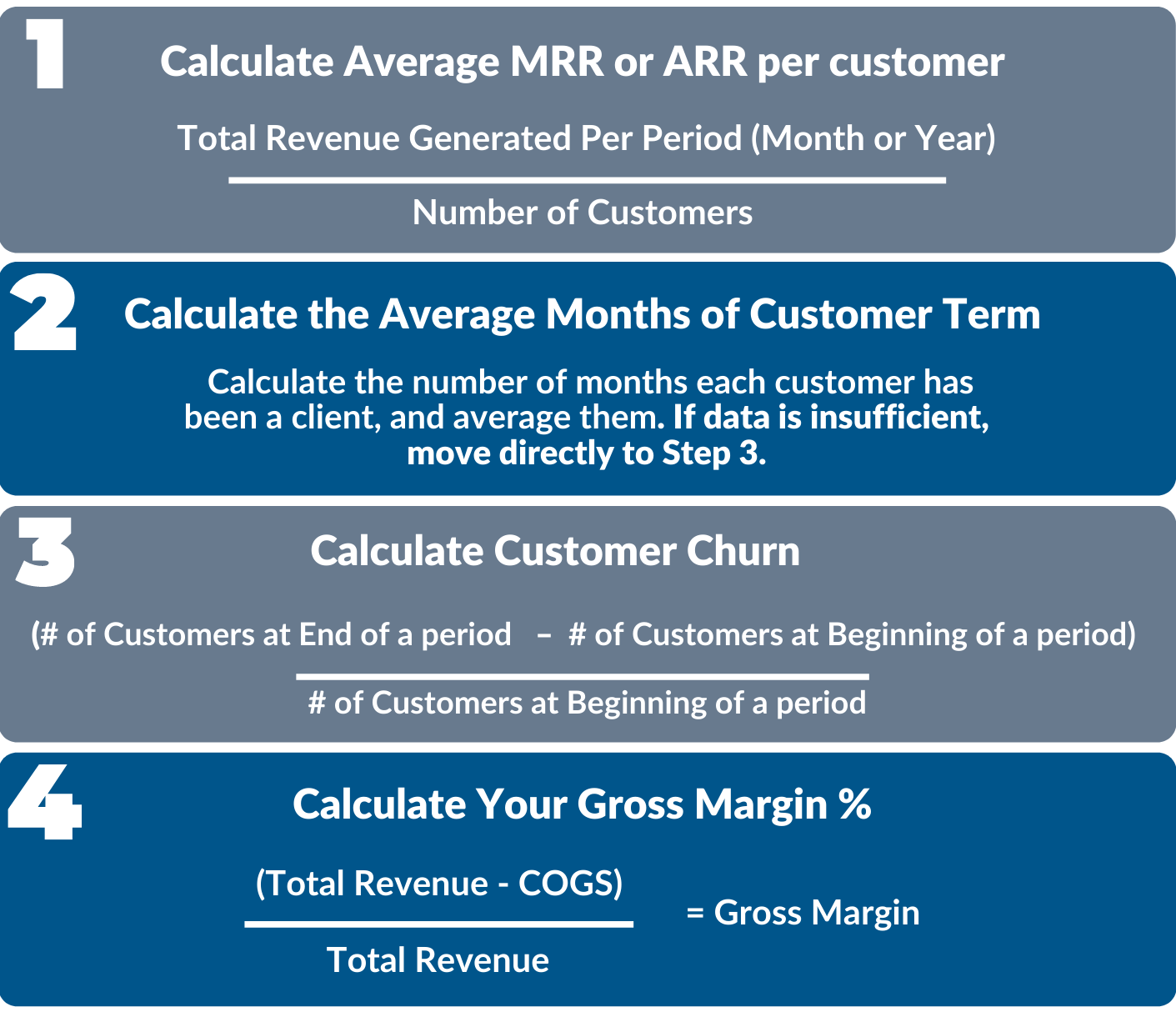

In order to calculate LTV, you need some historical financial data given the time component necessary for the calculation. Keeping this in mind, there are a few ways you can look at LTV. Let’s focus first on the variables you’ll need to calculate to determine your LTV calculation. Follow these steps and formulas to gather the information you need. Note that “period” can be defined as monthly or yearly, just make sure you are consistent when calculating.

Step 5 – Pick an LTV formula and period length that best fits the financial information you have

There are a number of ways to calculate LTV depending on the amount of customer data that you have. Now that we’ve quantified each variable listed above, we can review a few of the options. You just need to be consistent using monthly averages or trailing twelve-month averages depending on which period you want to use.

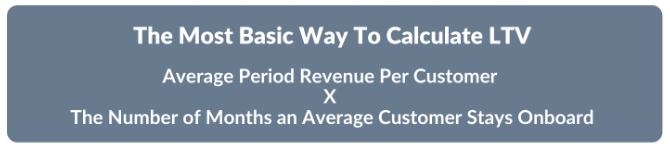

If you have sufficient time data, the most basic way to calculate LTV is simply using:

This calculation certainly makes sense. If a customer is paying you $5,000/m and remains a customer for a year, their LTV is $60,000. The obvious problem here is that some customers may stay with you for years. This method is backward-looking, and won’t predict how long customers will stay with you into the future.

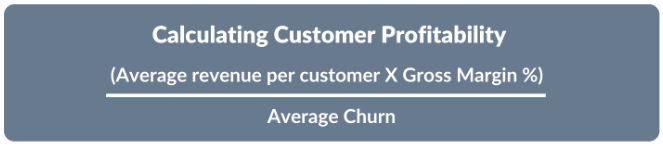

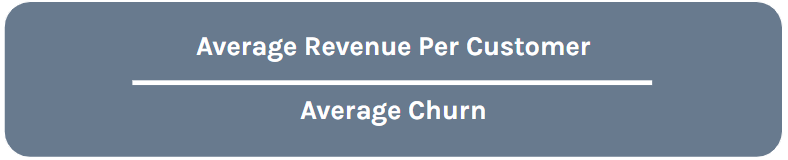

A different method to determine LTV that helps predict future value is using your average monthly churn rate. Simply use:

In this calculation, if a customer is paying you $5,000/m and you experience a 5% average monthly churn across your customer base, LTV would be $100,000 ($5,000/.05). This is basically saying, if on average we lose 5% of our customers in an average month, the typical customer will stay with you for an average of 20 months based on your churn rate. You’ll likely get a better sense for average monthly churn after 3-6 months and can start to estimate LTV without having to wait years to calculate the average number of months customers stay onboard.

To understand customer profitability, you can incorporate gross margin to calculate how profitable a customer is over the life of their engagement. To calculate, use:

So in the example above, if you generate 60% gross margins, you would generate $3,000 in gross profit ($5,000 X .60). Dividing $3,000 by 5% would give you $60,000 in lifetime profitability per client.

What if I don’t run a software or recurring revenue business?

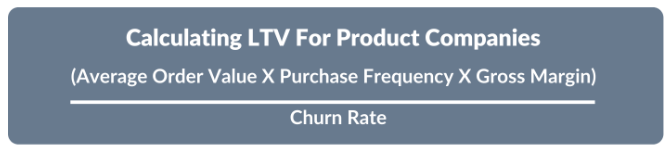

These three calculations work well for software companies and service businesses, but what about product companies? We can look at LTV in a more granular way:

To calculate Average Order Value, simply divide total revenue for the measurable period divided by the number of orders. To walk through an example:

- $100,000 revenue generated in a month divided by 500 orders equals an average order value of $200.

- Purchase frequency is just the total number of orders divided by the number of unique customers. So if 500 orders were made by 400 people or a purchase frequency of 1.25. So on average a single customer made 1.25 orders over the measurement period.

- Using our churn equation from above it’s likely in a product business that the majority of customers won’t be repeat purchasers, so churn is likely to be higher, lets use 75% for this example with gross margins at 40%.

The lifetime profit value for an average customer for our products business would be:

($200 (AOV) X 1.25 (PF) X 40% (GM)) / 75% = $133 LTV

CAC:LTV Ratio is Next

As you can see, LTV is an important metric when measuring the viability of your business model. But just like Customer Acquisition Costs, LTV doesn’t necessarily provide all the actionable information you need. In our next post, we’ll dive into the CAC:LTV ratio to determine how your business is actually performing, and if you are acquiring customers profitably. If you haven’t already read our Customer Acquisition Cost post from before, it’s linked below!

Click Below To Check Out Our Previous Blog!