Last week we provided an overview of the latest changes for the Second Draw of the PPP. Banks have begun processing loans and as of January 19th, over $5 billion in loans have already been approved out of the PPP Second Draw. Speed will be of the essence, as banks begin processing loans. It will be critical to have all the information needed in order to expedite the process, minimizing the risk of delays due to a missing form or information. To mitigate the risk, Compass East has put together a PPP Documentation Checklist to aid in your information gathering process.

Before we get into the checklist, it is important to note recent changes surrounding the PPP Second Draw that could potentially affect your business’ eligibility. We’ll walk you through how to determine if you are eligible for the Second Draw of PPP.

Revenue Losses

One of the most significant requirement changes is that borrowers will need to demonstrate a reduction of at least 25% of “gross receipts” in the first, second, or third quarter of 2020 when compared to 2019.

Under SBA rules, “Receipts” are defined as “revenue in whatever form received or accrued from whatever source, including the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances”. The SBA notes that if you received a First Draw PPP loan that was fully forgiven, it does not count in the gross receipts reduction requirement when showing a loss.

The SBA also provides an alternative method to comparing year over year losses due to COVID. Since quarterly statements might not be readily available, a borrower that was in operation for all four quarters of 2019 can submit copies of its annual tax forms that show a reduction in annual receipts of 25% or greater in 2020 compared with 2019 to qualify.

Were you in Business on February 15th, 2020?

To be eligible for PPP Second Draw, companies must have been operational on February 15th, 2020. Which poses an interesting question, what if you started in December of 2019 and can’t compare first, second, or third-quarter losses in 2019? But you still meet the operational requirements?

The SBA provides some flexibility when comparing quarters. If you:

- Opened in the third quarter of 2019? Compare any 2020 quarter to the third or fourth quarter of 2019.

- Opened in the fourth quarter of 2019? Compare any 2020 with the fourth quarter of 2019.

- Opened in January 2020? Compare the second, third or fourth quarter with the first quarter in 2020.

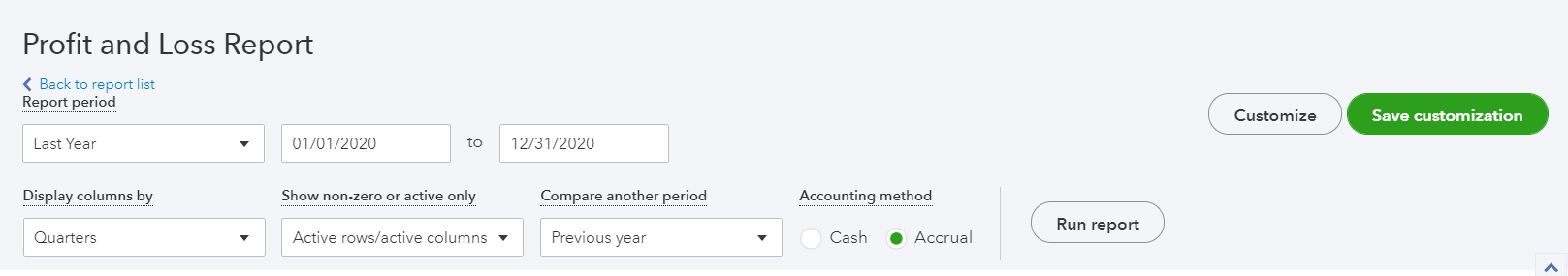

Determining Revenue Losses in Quickbooks

So before collecting any documentation you will need to run your year over year P&L reports to determine if you meet the 25% decline threshold. Here is a step by step way to review your P&L to determine loss amounts.

- Step 1: Login to your Quickbooks account

- Step 2: On the left side of your console, click Reports and then click Reports again on the popout to bring you to your Reports page.

- Step 3: Click the Profit and Loss report

- Step 4: To customize the P&L report to show if you are eligible for the PPP requirements go to the top section of your P&L report. For the Report Period choose “Last Year” which should automatically report 2020 P&L. Then Display columns by Quarters. Next, in Compare another period select the dropdown. Check Previous Year (PY) and check Percent Change. Then click Run Report.

- Step 5: This will show your 2020 Income Statement by Quarters and will show the Current Period (in 2020) compared to 2019. If the first, second or third period shows a 25% or greater reduction in revenue, you meet the revenue reduction guidelines.

- Step 6: If you don’t immediately hit the 25% threshold, check your gross profit calculation for returns and allowances and subtract them from the total revenue number to see if they reduce topline revenue enough to qualify.

Tax Return Alternative Method

Alternatively, the SBA allows for a full year comparison of the Income Statement to meet the 25% revenue reduction requirement. Use the same steps from above but simply check Display Columns by Years to compare full-year financials. For the application, however, you would just submit 2019 and 2020 tax returns to compare.

Employee Headcount

A reduction from the Employee Headcount of 500 in the original guidance, only Businesses with less than 300 full-time, part-time or seasonal employees are eligible for The PPP Second Draw. Obviously, for small businesses, this will not be a major issue, but it’s worth noting.

Payroll Documentation

If your business applied for a PPP loan in the first round for less than $150,000 and plans to use the same lender for the Second Draw, then submission of 2019 payroll documentation is optional. Most banks are also allowing you to use the same data submitted for the First Draw to cut down on application time. However, if you used a trailing twelve month method the first time around to calculate payroll amounts, then you will need to provide all new payroll data.

What Supporting Documentation is Requested from Banks?

Make sure to have the following information available for your PPP loan application:

- 2019 and 2020 Annual Payroll Register

- 2019 Form 941: Employer’s Quarterly Federal Tax Return (2020 If Available)

- 2019 Form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return (2020 If Available)

- 2019 Tax Return, 2020 If Available

- 2019 and 2020 Balance Sheet and P&L Statement

- Proof of 401k Employer Contributions

- Copy of Driver’s License or Passport for ID for anyone with 20% or more ownership.

- 1099s – despite Independent Contractors not counting in the payroll cost calculation we’ve still had banks asking for 1099s. We’re providing to avoid slowing down the application in any way.

- Proof of health insurance payments – Invoices/bank statements

- FEIN #

- Business Address

- W-3: Transmittal of Wage and Tax Statements