All too often, CEOs whose companies have multiple product or service lines lack a clear picture of which products or services are actually most profitable. If you aren’t tracking metrics such as revenue, related costs, and profits for each line, how can you be sure you’re making the right decisions for the good of your business?

Many of the CEOs we work with have a general understanding of how their business is doing—for instance, they might reference their point of sale (POS) system to see that top-line sales are growing and conclude that they’re doing well. The problem? They don’t have enough information to understand where that growth is coming from. Which products or services are most profitable? Which are underperforming? How should the business move forward?

Until you have the data, you can’t make the decisions.

Using Profitability Analysis in Your Business

If you’re only looking at top-line revenue, or even if you’re only tracking overall profitability, you’re missing out on an opportunity to better understand how your business performs.

Tracking profitability for individual products or services, which includes revenue and all related costs for delivering that product or service, provides a deeper level of financial insight. You’ll need that detailed information if you want to forecast the future. Because if your margins are slowly ebbing away, you need to know why—and what you can do to fix it.

Here’s a simple example of a problem we often see with well-established companies: You own a construction business that builds fences. Lumber and labor costs have skyrocketed in recent years, but you’re not adequately tracking these costs. Your revenue is increasing, but at the end of the year, your profit is shrinking. How can you know if you’re increasing your prices fast enough to maintain profitability? The simple answer is: You can’t.

If you don’t know your gross margin and the related COGS percentage, you’ll be none the wiser, completely unaware of potential business issues that should be addressed. No matter what kind of business you run, you need to get under the hood to determine which products or services are profitable and which ones aren’t. Only then can you make the most strategic decisions for your business.

Here’s a look at the process Compass East uses to conduct product profitability analyses for clients so they can gain clearer pictures of their businesses.

Conducting a Product Profitability Analysis

A product profitability analysis begins with the basics: working with client-side operators to develop a comprehensive list of a company’s products and services.

Let’s say our client runs a cosmetic dermatology practice that offers Botox and HydraFacial (services) and skin creams (products). The CEO knows the practice earned $500,000 in annual revenue but doesn’t have much more of a detailed picture than that.

The next step is breaking down the monthly financial data related to each product and service and tracking it on the profit and loss statement (P&L) and chart of accounts (COA).

What products are required to provide Botox and HydraFacial services, and what are the associated expenses? What is the cost of the skin creams? Which staff members are involved in providing the services, and how much time do they spend per procedure? Which specific injectables, patients, and appointments generated the most revenue? Our team will work with the practice operators to get all of this information.

Products are generally easier to break down than services. Selling a skin cream for $20 per bottle that costs $5 per bottle wholesale is relatively straightforward, whereas a service like Botox could involve three people performing different tasks throughout the procedure.

How much does 15 minutes of the doctor’s time cost versus one hour of the nurse practitioner’s? Having that data available can lead to changes in policies and processes, such as transitioning the bulk of a task to a lower-cost employee.

The big challenge: gathering the necessary data

One of the biggest challenges of a product profitability analysis is acquiring the necessary data. Relevant data. Accurate data. Enough data.

Ideally, companies are able to provide a clean data set for our finance and accounting team to work with. We may need to perform analysis on that data before uploading it into our systems so that we include what’s meaningful for financial purposes. If needed, our team can directly access a client’s operational systems to pull the data ourselves. We’ll then establish regular data variance checks with our point of contact in the beginning stages of the engagement to ensure we’re gathering accurate data.

If our point of contact doesn’t have the granular information we need, we may work with other leaders in the organization who do. The good news is that we’ve encountered countless third-party systems over the years and can provide ample support in identifying what data is currently available and missing. Our team then establishes processes to fill in the gaps and ensure we can access clean, timely data on a regular basis.

Presenting the data from a product profitability analysis

One of the goals from a product profitability analysis is to update the COA to align more sensibly with the company’s products and services. This information will then appear on the monthly P&L and balance sheet and make it easier to see, at a glance, how each line of business is performing.

How we group data—and to what level of granularity—varies widely depending on the business type and the product and service offerings. There’s a fine line between showing enough data, which gives leaders the context they need to make decisions, and too much data, which can overwhelm them. Keep in mind that it’s always possible to conduct a deeper analysis if needed.

We advise having a single source of truth for your data, such as a third-party tracking system. As long as you have that in place, we can structure the data in many different ways to provide useful reporting.

Often, we’re looking to answer the question, “What are the biggest drivers of revenue and profit margin?” The data might show, for instance, that the loss-leading services at the cosmetic dermatology practice are getting clients in the door and enticing them to book more profitable services. The company now has proof that their loss-leading strategy is working.

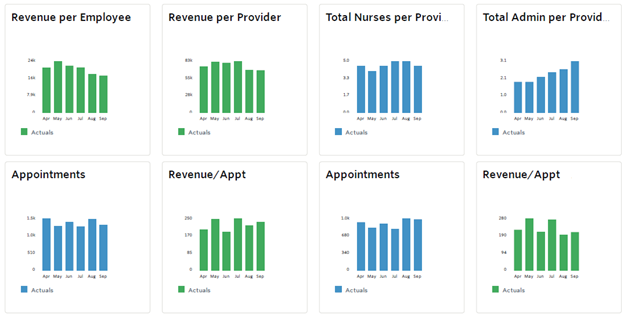

We could also report on which providers are driving the most revenue—a popular metric at a dermatology practice because the providers are not only integral to bringing in clients but also compensated based on commission. It quickly becomes clear that the number of appointments isn’t the only useful metric; it’s also crucial to track factors like time spent per appointment and products and services sold to get an accurate picture of the highest-performing providers.

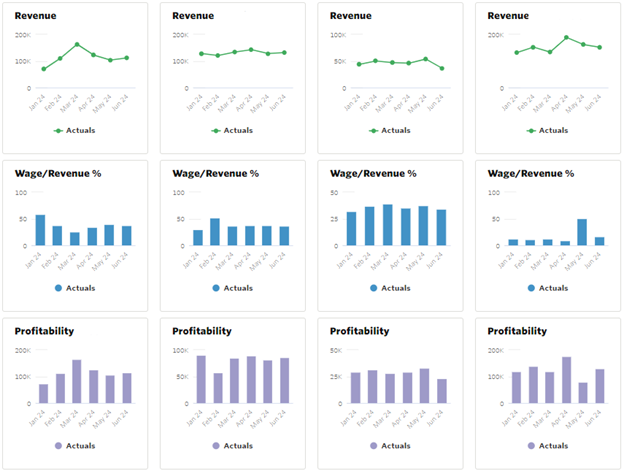

Here are some examples of the metrics we might track:

What Companies Gain from a Product Profitability Analysis

A product profitability analysis is an extremely valuable exercise for any organization looking to gain a clearer picture of their business. In summary, here’s what you can expect to take away from it:

- Benchmarks and targets. Benchmarking the current state of your company’s profitability gives you a clear starting point from which to build. From there, you can set targets to work toward and track your progress.

- “What’s measured gets managed.” The popular business aphorism attributed to Peter Drucker proves itself time and again. You’re more likely to act on information when you can see it in front of you.Company-wide standards. Throughout this process, you’ll establish standards for how your organization defines profitability, ensuring consistency from one department to the next.Improved profitability. There are a number of actions you can take to improve your profitability, including making price adjustments, implementing operational efficiencies, leveraging buying power, creating competition for sourcing, and more. It all starts with getting visibility into your financial data.

- Smarter business decisions. Tracking and reporting on data pertaining to your business’s product and service lines empowers you to make informed decisions about how to grow your business. You may even identify opportunities to pivot a business model or niche into a specific high-demand area that will boost revenue.

No matter where you are in determining which of your products and services are most profitable, Compass East can meet you there. Book your free consultation to start the conversation.