If you are one of the 28,000 Tennessee businesses potentially eligible for the Tennessee Business Relief Program (TBRP), be on the lookout for notices of eligibility being issued by the TN Department of Revenue this week. The $200 million relief program was announced by Governor Bill Lee on June 2nd and leverages Coronavirus federal relief funds to issue one-time payments to businesses that were forced to close during the mandatory lockdown period. The good news for Tennessee companies weary from navigating PPP application complexities is that the TBRP will have no application. Eligibility will be determined based on annual gross revenues listed in business and sales tax returns collected by the Department of Revenue. A business will just need to confirm the eligibility notice sent this week and funds will be directly deposited or mailed via check the first week of July. This is a grant program and qualifying payments do not have to be repaid.

Who is eligible for payments?

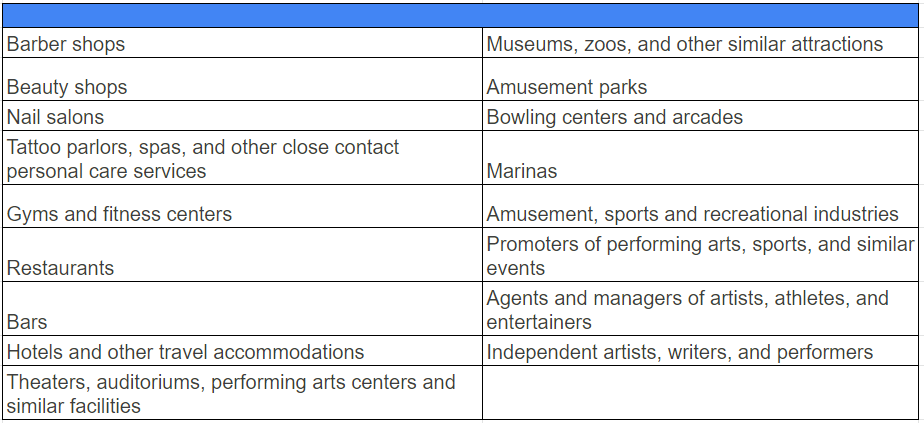

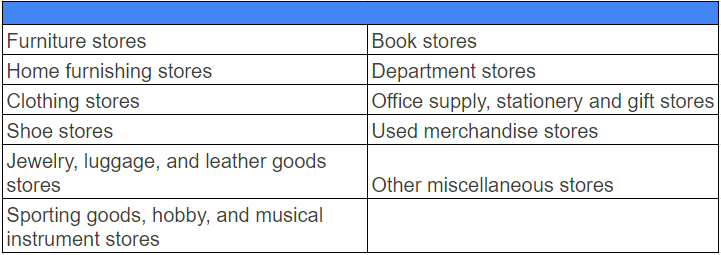

Businesses with less than $10 million in gross revenues will receive payments. The following business types are eligible:

In addition, the following small businesses are eligible if their sales were reduced by at least 25%, as shown on their April sales tax returns (filed in May):

If your business has multiple locations, the payment amount will be determined by the combined gross revenue of all locations instead of individual payouts to each location.

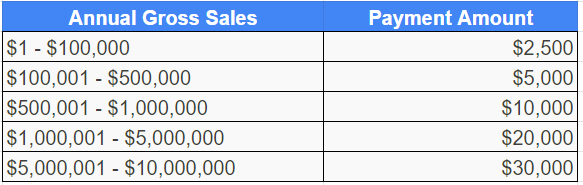

How much money will you receive?

Gross sales totals for each eligible business will be based upon what the business reported on its applicable sales or business tax returns. The amount will be determined by looking at the greater of:

- Reported gross sales on its calendar year 2019 sales tax returns, or

- Reported gross receipts on its most recent business tax return.

Companies that are less than 12 months old are still eligible for payments but the department is in the process of determining a final method of measurement for those businesses and additional guidelines will be issued. Companies are still eligible even if you received PPP or EIDL relief funds from other programs.

Once the certification form has been completed and a business’ eligibility is confirmed, the department will issue a business relief payment. Payments will be made by direct deposit if the business has previously provided bank account information and authorized the Department to save that information. Otherwise, payments will be made by check.

What can funds be used for?

The good news is that the use of funds is relatively broad for affected businesses. The FAQs state that funds “should be used to respond to the financial disruption resulting from COVID-19 and its effects on your business”. The only restriction is that “Funds must not be used for payment of tax liabilities to a government agency”.

The website FAQs state, however, that records must be kept regarding how funds are spent and by accepting funds, “businesses acknowledge and agree that they are subject to potential audit or other verification by the State of Tennessee concerning the qualification for and use of these funds. Funds are subject to recapture by the State of Tennessee if payment requirements are not met”.

So make sure to keep proper financial documentation and records!

Next steps?

Simply be on the lookout for award notification this week and follow these instructions to confirm the pre-award certification:

- As indicated in the notification, please visit https://tntap.tn.gov/eservices. DO NOT log into your account at this time.

- Look for the heading “Tennessee Business Relief Program” at the top right of the TNTAP homepage.

- Click on the link labeled “Tennessee Business Relief Certification/Status” and enter the required information.

- Once the pre-award certification has been completed, please print or otherwise note the confirmation number for your submission.

Questions? Finance and Accounting needs? Schedule a Free Consultation today!

John Lanahan

Director Of Financial Strategy

john.lanahan@compasseast.com