Defining the Traditional Finance and Accounting Team | The Finance Team | The Accounting Team | Common Issues With This Model for Early Stage Companies

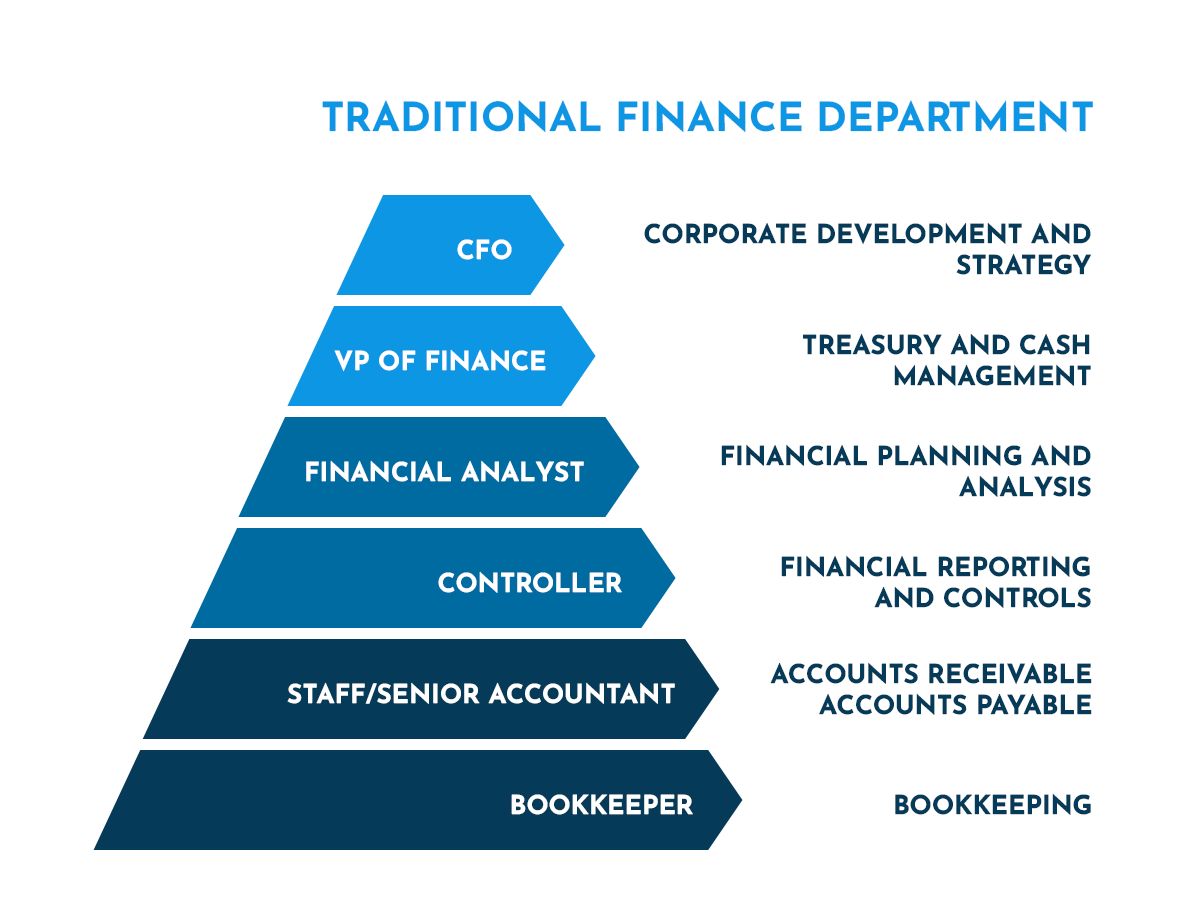

Once you understand the key functions of the finance and accounting teams, the next step is to understand who in an organization is responsible for what. Broadly speaking, finance and accounting are separate functions. Traditional accounting team members are usually responsible for day-to-day transactions and the recording and reconciling of those transactions. Traditional finance team members focus more on long-term strategy. Accounting typically concerns itself with compliance and the past, while finance concerns itself with strategy and the future.

Let’s take a closer look at who’s who on a traditional finance team and accounting team and how certain roles and expectations can contribute to common finance and accounting department issues.

Defining the Traditional Finance and Accounting Team

If you built a house, where would you start? Often, the best way to build a home or any other structure is from the foundation, or bottom, up. It doesn’t make sense to start with the roof because without a foundation and solid walls, there’s nothing to hold it up. The same is true when building a finance and accounting team.

While building a solid foundation should be the way to go, many companies take a “top-down” approach when building out their finance and accounting functions. Companies commonly start by hiring a Chief Financial Officer (CFO), thinking that the CFO is a jack of all trades and can address both finance and accounting issues. In reality, the CFO is the roof of the finance team. They can protect the finance department, but they need the security and support of a solid foundation and sturdy walls.

In some cases, startup companies will hire a Bookkeeper first and expect them to handle all tasks and responsibilities related to finance and accounting. The lone Bookkeeper is likely to become overwhelmed, especially as the company’s financial needs grow more complex.

To help your company better understand who it needs to hire and when, let’s take a closer look at each position on a traditional finance team and a traditional accounting team. We’ll define each position and discuss how they connect to each finance and accounting function.

The Finance Team

The finance team focuses on how a business manages its money. Members of the finance team often work on creating a budget for individual departments or the company as a whole. They might forecast the business’ financials or map out a strategy to help the company maximize profit. The roles and positions on a traditional finance team include:

Chief Financial Officer

The Chief Financial Officer is the highest-ranking member of a company’s financial team. They are part of the company’s overall executive team and usually rank up there with the Chief Executive Officer (CEO) and the Chief Operating Officer (COO).

As the finance team leader, the CFO should take a big-picture approach to a company’s finances. They usually take care of strategic planning and the implementation and management of financial activities, such as budgeting, forecasting, negotiations and business planning.

F&A Function of the CFO: Strategy Development, Treasury and Cash Management and Compliance.

VP of Finance

In a traditional finance department, the VP of Finance reports directly to the CFO. The VP of Finance analyzes a company’s profits, costs and compliance. They make sure information gets reported in a timely fashion, the company manages risks appropriately and all financial data is accurate. The VP of Finance may also oversee many accounting operations, including accounts receivable and payable, payroll, and financial reporting.

F&A Function of the VP of Finance: Treasury and Cash Management and Compliance.

Financial Analyst

The Financial Analyst often builds financial models and forecasts for the VP of Finance and the CFO. They forecast revenues and expenses to establish cost structures. They also create capital budgets for projects.

While the CFO and VP of Finance are usually individuals who have ample experience in finance, a Financial Analyst is typically someone who is just getting started. It’s a more junior position on the team. For that reason, the Financial Analyst is usually the person who does a fair amount of heavy lifting when it comes to building and adjusting the financial models.

F&A Function of the Financial Analyst: Financial Planning and Analysis (FP&A), Financial Reporting and Controls.

The Accounting Team

While the finance team focuses on a company’s big-picture strategy and overall financial health and well-being, members of the accounting team zero in on the day-to-day functions of money. The roles and positions on an accounting team traditionally include:

Controller

A Controller is a senior-level position that traditionally reports to the CFO or VP of Finance. The primary responsibility of the Controller is to oversee the accounting operations of a business. They typically plan and direct all accounting operational functions and manage the consolidation of all financial data to ensure the accurate representation of financials. A Controller also plays a key role in ensuring a business remains compliant with all regulations and requirements.

The Controller will have a significant role in managing an audit process and developing departmental budgets. A Controller can make a major contribution to the company’s strategy, forecasting and reporting at a smaller company.

F&A Function of the Controller: Financial Reporting and Controls.

Senior Accountant

The Senior Accountant is typically the person in charge of supervising the rest of the accounting team. As a senior member of the accounting team, they are responsible for ensuring the integrity of a company’s accounting information. Some of their day-to-day tasks and duties include preparing financial reports, performing account reconciliations, preparing and filing tax returns and responding to audits. The Senior Accountant typically reports to the Controller and might be assigned other tasks by that person.

F&A Function of the Senior Accountant: Financial Reporting and Controls, Compliance.

Staff Accountant

A Staff Accountant is a more junior role on the accounting team. Staff Accountants typically work under the supervision of a Senior Accountant or Controller. Their tasks usually include performing general bookkeeping, preparing and analyzing budgets, and keeping ledgers. The exact role of a Staff Accountant can vary considerably from company to company, based on the company’s industry and the size of its accounting team.

F&A Function of Staff Accountants: Accounts Receivable, Accounts Payable and Compliance.

Bookkeeper

A Bookkeeper helps a company keep track of how much money comes into the business and how much flows out of the business. Their responsibilities include recording transactions, reconciling bank and credit card statements, and processing payments. Data entry is a key component of the bookkeeping role. A Bookkeeper will usually be in charge of entering sales and expenses into a company’s database or spreadsheet. They might be the person that employees send receipts and expense records to.

Usually, a Bookkeeper position is an entry-level role. A person can become a Bookkeeper without a special degree, training or certification.

F&A Function of a Bookkeeper: Bookkeeping, Accounts Payable and Accounts Receivable.

Common Issues With This Model for Early Stage Companies

Larger companies often have full, in-house finance and accounting departments. It’s usually a different story for companies with less than $25 million in revenue. Smaller businesses tend to handle finance and accounting in several different ways. A helter-skelter approach to finance and accounting can complicate things for smaller businesses. When they don’t have a true playbook, founders and owners tend to commit the same mistakes when building the finance and accounting departments.

Let’s look at the common mistakes companies make during their life cycle when trying to maximize their finance and accounting output:

1. Inefficiency From Office Manager, Bookkeeper or Founder Handling Finances

When companies are first getting started, they often don’t have the budget to hire executive-level finance team members. At the same time, the finances of a new company are usually relatively simple and often don’t require a large team. In the earliest stages, it’s common for the company founder or an office manager to manage the books and accounting. The founder might act as the company’s Controller and approve invoices, send out invoices, write the checks and take care of payroll.

Often, they might use a program such as QuickBooks for bookkeeping and accounting. It’s also possible for a new company to manage everything manually in Excel, as it might not have many financial or accounting transactions to perform just yet.

What works at the beginning can develop into a problem for a business, particularly as it grows. When the founder or an office manager handles the finance and accounting tasks, they can get overwhelmed as their other responsibilities or complexity increases. It could also be the case that the person hired to handle a company’s books doesn’t have the skill or expertise necessary to manage other financial aspects. Manual processes inevitably create bottlenecks when a founder or another unqualified individual heads up the finance and accounting team, which can lead to frustration and inefficient uses of time.

2. Letting the CPA Deal With It

Certified public accountants (CPAs) may offer tax services as well as basic bookkeeping and accounting services. Having the CPA take care of taxes, bookkeeping and other accounting tasks can make sense to many founders. A founder might think, “This person handles my taxes, so they can handle my accounting.”

While many tax CPAs can handle accounting, it’s not what they want to do. They want to focus on staying on top of changes in tax law, advising clients on minimizing their tax burden, and filing taxes at the end of the year. Taking on a company’s books and accounting can distract them from their overall functions. It can also mean that each task doesn’t get the attention or care it deserves.

A lot of CPAs work in one-person shops and have limited capacity. When they try to do too much for a company, books don’t get closed regularly, balls get dropped and they only do after-the-fact accounting, which can’t provide real-time information and financial insights to your business.

3. Using Manual Processes

There can be a comfort to sticking to what you know, but that comfort can also hold back your business. Companies may develop manual accounting processes, such as manual data entry, at the beginning of their operations. Those processes tend to stick, often for the simple fact that they’re the way a company has always done things. As time goes on, it can be more difficult for a company to change course or adopt new practices and processes, so the slow and taxing ways of doing things stick around.

In some cases, a founder might try to introduce new accounting systems. Without a full understanding of how automated systems or accounting software works, it can be easy for a team to get frustrated. They are likely to turn back to the old way of doing things, even though the old way has its own problems. Over time, a company that clings to a manual system can see its growth stall.

5. Lack of Investment

Even if a founder realizes the value of maintaining excellent books and developing a financial strategy for their company, it is often not their primary concern or focus. They started their business to solve a problem or help make people’s lives better. Other things, such as finance and accounting, are just necessary evils. Some founders see finance and accounting as a cost center rather than a tool to drive revenue. To reduce the cost center, they might minimize it, often by underinvesting in the departments.

One way to do that is to work with an inexpensive, outsourced provider. The services a company gets when it outsources might not cost much, but at the same time, they aren’t delivering much. Underinvesting in finance and accounting can mean a CEO doesn’t get timely, accurate and actionable financial information about their business. They are flying blind, which can make it challenging to make on-point strategic decisions.

6. Top-Down CFO

It’s fairly common for companies to take a top-down approach when staffing their finance and accounting teams. They might set out to hire a CFO, believing that bringing on an executive-level professional will solve all their finance and accounting problems.

While a CFO can be a valuable member of a finance team, they aren’t miracle workers. They have a specific skill set and will do an excellent job helping a company develop its financial strategy, forecasts and other finance-related functions. But they aren’t accounting experts and won’t handle the day-to-day accounting basics many companies need. Your business will most likely need to hire other roles, such as accountants and Bookkeepers, to supplement the role of the CFO.

Often, companies that focus on building from the bottom up, hiring the Bookkeepers and accountants first, spend less money and avoid many of the issues faced by companies that took a top-down approach.

Let Compass East Improve Your Finance and Accounting Team

Whatever challenges your company faces when it comes to your finance and accounting departments, Compass East can help. We work with companies across a range of industries, helping them grow and improve. If your business has revenues between $1 million and $25 million and you’ve put together a strong operational team, we can create a scalable process that will allow your company to grow. To learn more, contact us today.