Accounts Receivable and Payable | Tax and Compliance | Payroll | Financial Reporting and Controls | Treasury and Cash Management | Financial Planning and Analysis | Corporate Development and Strategy

The finance and accounting (F&A) team at small and early-stage businesses is responsible for several core functions. Understanding what each function is and does is critical to implementing the most efficient F&A structure based on your needs. The core activities within each function grouping can vary depending on the business size and type.

We’ll cover the key functions of the finance and accounting department at a growing business and address how we can support growing businesses, providing what they need at each phase of their life cycle. Some functions, such as investor relations and risk management, are typically reserved for publicly traded companies or large enterprises. Since Compass East focuses on businesses with revenues under $25 million, we won’t touch on those functions today.

1. Accounts Receivable and Payable

Money in, money out. At a very fundamental level, the team managing your accounts receivable and payable is responsible for managing the flow and timing of money coming in and going out of the business. In essence, accounts receivable (AR) is what other companies or individuals owe your business, while accounts payable (AP) refers to the money your company owes to others, such as vendors.

Accounts Receivable

What are accounts receivable? Accounts receivable is the amount of money due to your company in the short term. It’s what’s owed by clients or customers of items or services they received but have yet to pay for. Since accounts receivable should be paid for by customers relatively quickly, the amount is usually listed on your company’s balance sheet as a current asset. The time frame clients have to pay can range from several days to several months.

At your business, the accounts receivable department likely serves two primary functions. It sends invoices to customers, and it accepts payments. How frequently the AR department sends invoices to customers depends on several factors:

- The contract your company has with the customer.

- How frequently the customer purchases from you.

Your company might invoice after each purchase or wait until the end of the month and send a single invoice for all of the services or products a customer purchased that month. The AR department might also determine when to set due dates for payments, using the customer’s contract as a guide. For example, your company might agree to net-30 or net-60 payments, meaning the customer has 30 or 60 days from receipt of the invoice to pay. You can also request that customers pay upon the receipt of the invoice.

The AR department accepts payments from customers, which can take several forms. For example, it might establish auto payments from clients using a credit or debit card. It then needs to ensure that each client’s payment method is up-to-date. Other payment forms include automated clearinghouse (ACH), wires and checks. Should a customer fall behind in making payments, the AR department usually follows up with the client. If the client still doesn’t pay their past-due invoices, the department might need to hand off the account to a third-party collection agency.

Accounts Payable

What is accounts payable? Think of it as the opposite of accounts receivable. It’s the money your company needs to pay out to others. Accounts payable is responsible for accepting invoices from suppliers and vendors and logging the invoices into your company’s accounting system. When the AP department receives an invoice, it needs to ensure that the bill is coded to the appropriate department or account and that it has the approval to pay it before it schedules the payment.

Once the invoice is approved based on a company’s approval process, the AP department sets up payment. It can pay via check, credit card, wire transfer or ACH, which is also called direct deposit. When each invoice gets paid is determined by the agreement your company has with the supplier or vendor. You can pay on net-30 or net-60 terms, for example. Alternatively, you might have agreed to pay a vendor immediately after receipt and approval of the invoice.

AP doesn’t just handle invoices from third parties. It also takes care of internal payables, such as expense reimbursement for employees or department expenses. Employees who need reimbursement will typically submit their receipts and expense reports to the AP department to review and approve. Someone from AP will log the receipts, ensuring that they are coded correctly in your company’s system. If the expenses are approved, the AP department will issue payment to the appropriate employee or department.

2. Tax and Compliance

While taxes might be one of the only certainties of life, figuring out what your business needs to do to stay compliant with taxes and avoid paying a hefty tax bill is far from certain. However, understanding what tax and compliance are is critical to the ongoing success of your business.

The certified public accountant (CPA) often acts as the main tax compliance officer for a small business. Your company’s CPA is likely to file your tax returns at the year’s end. They can also advise you about potential tax savings or credits you qualify for. Your CPA might also ensure that your business pays the appropriate amount of quarterly estimated taxes based on its income.

Along with business income tax, your company might be responsible for certain employment taxes if you have employees. Businesses must pay half of their employee’s Social Security tax and Medicare tax. They also need to withhold the other half of the Social Security and Medicare tax from their employee’s pay. While your company isn’t obligated to withhold employees’ federal or state income tax, many businesses do so, which can help their employees manage their taxes easily.

Usually, the human resources (HR) department or your company’s payroll administrator plays a role in employee tax withholding. HR or payroll might also be responsible for accepting Form W-4 from new hires and filing Form W-2 at the end of the tax year. If your business works with independent contractors, your HR department or payroll team will also issue the appropriate Form 1099 to those companies or individuals.

Larger companies might also have a separate compliance department, which seeks to manage risk and minimize potential regulatory exposure. The compliance department keeps a watch on certain financial controls and monitors sales tax owed. It also files the annual report for a business.

3. Payroll

The payroll administrator is one of the most important members of your company’s team, but often the importance of the function isn’t understood until something goes wrong. One way to see the importance of payroll is to mess it up and watch what happens. The odds are likely that you’ll have more than a few disgruntled employees on your hands.

Your business can have an in-house payroll team or outsource the tasks and responsibilities to a third-party provider. Whether in-house or outsourced, payroll needs to make sure that each employee gets paid what they are owed at the appropriate time. Some of the responsibilities of the payroll department include:

- Onboarding new employees and entering their information into the payroll system.

- Tracking employee time and auditing timesheets to ensure compliance with company rules.

- Calculating and recording deductions such as taxes withheld, health insurance and employee 401(k) contributions.

- Calculating wages owed, as well as overtime.

- Maintaining commission schedules.

- Preparing payroll reports, scheduling ACH transfers and ensuring employees receive their paychecks on payday.

- Submitting tax filings for each employee.

It’s important to understand that payroll should be reserved for paying employees only. Payments due to non-employees, such as freelancers and independent contractors, should be handled by the AP department directly, as your business doesn’t need to withhold taxes or other deductions from the payments you make to freelance or independent contractor team members.

The payroll function is often one of the first functions a company outsources to a third party.

4. Financial Reporting and Controls

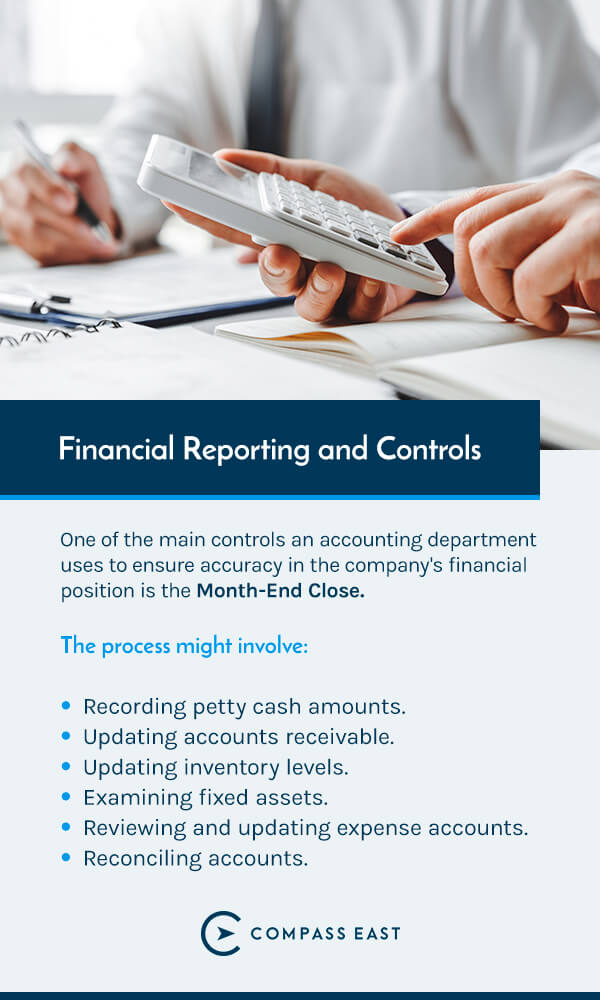

What are financial reporting and controls? Financial reports are what the accounting department produces. Controls and processes ensure that those financial outputs are accurate and compliant.

One of the main controls an accounting department uses to ensure accuracy in the company’s financial position is the Month-End Close. During the Month-End Close, accountants, bookkeepers and controllers read over, record and reconcile information. The process might involve:

- Recording petty cash amounts.

- Updating accounts receivable.

- Updating inventory levels.

- Examining fixed assets.

- Reviewing and updating expense accounts.

- Reconciling accounts.

After completing the Month-End Close, the controller reviews a company’s financial statements to ensure accuracy. The accounting team will then deliver a three-statement financial report to the management team. The financial report will include:

- The income statement, which shows how much revenue a company earned during the period and whether it was profitable or not.

- The balance sheet, which lists a company’s assets and liabilities.

- The cash flow statement, which shows how much cash or its equivalent is coming and going from a company.

The Month-End Close requires a considerable amount of work, which is why it’s absolutely critical for a business to establish best-practice systems and workflows. Having the right team in place will also help to streamline the process on the front end.

5. Treasury and Cash Management

The controller and senior accountants who work for or with a small business typically also take on treasury and cash management responsibilities. At larger companies, treasury management is often its own department.

What is treasury management? It’s the process of determining the levels of cash a company needs to meet its obligations. Some of the tasks a treasury manager needs to handle include the following:

- Collections

- Disbursement

- Information reporting

- Capital management

- Risk management

The people tasked with treasury management also typically need to put together a monthly cash forecast. The forecast should include updates on collection cycles, AP balances and anticipated payments, planned capital expenditures, one-time expenses and anything else that will impact cash flow. The goal of the forecast is to ensure that your business uses its cash most efficiently.

During stressful times, a cash forecast can also help your company plan various scenarios. You can use the forecast to model payment plans and see how those plans affect your company’s cash levels.

6. Financial Planning and Analysis

The finance and accounting functions we’ve discussed above all focus on a company’s financial history. Recording day-to-day transactions, managing the money that comes into and flows out of a business and performing the Month-End Close all involve transactions that occurred in the past. In contrast, financial planning and financial analysis focus on the future. Financial planning and analysis (FP&A) interpret past data to predict the future. With FP&A, your business can build a financial plan. The FP&A team is responsible for the financial health of your company.

Some of the core activities FP&A team members perform include:

- Creating a budget: Often, the FP&A team will liaise with other departments to help them create annual budgets. It will then merge individual department budgets into one company-wide budget.

- Developing financial strategies: The FP&A team will also work closely with the management team to develop a company’s strategic financial plan.

- Reporting on key performance indicators (KPIs): Financial KPIs let your company know what it’s tracking and why. The FP&A team can determine which KPIs to track and keep tabs on them.

- Forecasting and modeling: The FP&A team also puts together financial models to project growth potential.

FP&A solutions link corporate strategy to execution, enhancing the finance department’s ability to manage performance. Often, financial analysts report to the Chief Financial Officer (CFO), who works with the rest of the Executive Team to inform strategic decisions.

7. Corporate Development and Strategy

The last finance and accounting function is corporate development and strategy. What is corporate development and strategy? It’s an action-minded plan that aims to help a company grow. At a larger company, the CFO usually leads corporate development and strategy. Some of the components include:

- Building long-term strategic partnerships with other businesses.

- Identifying opportunities for mergers and acquisitions.

- Determining the most strategic or efficient way to allocate capital.

In the case of mergers and acquisitions, the team in charge of corporate development might first identify gaps or needs within the organization. It can then search for products or market opportunities that fill that gap. At its most effective, a corporate development and strategy department can accurately assess risk and value, acquire the desired targets and create a significant number of deals. The goal of the department is to optimize business strategy.

Most companies with revenues under $25 million don’t have a separate, formal corporate development department. Instead, the company’s vice president of finance or CFO takes on the tasks associated with analyzing metrics to allow for strategic growth.

Contact Compass East for Finance and Accounting Services

If your business needs help with finance and accounting functions, Compass East is here to help. We’ve worked with companies in many different industries to provide bottom-up finance and accounting solutions. To learn more about how our services can help your company, schedule your free consultation today.