Retaining customers is a critical aspect of business success, as it not only ensures recurring revenue but also contributes to brand loyalty, customer advocacy and overall growth. When it comes to measuring customer retention, two important metrics come into play — net retention rate and gross retention rate. While they both provide insights into customer retention, they focus on different aspects of the customer base.

Below, we will delve into the concepts of net retention and gross retention rates, exploring their definitions, calculations and implications for software as a service (SaaS) businesses. By understanding these metrics and their nuances, you can gain valuable insights into your customer retention efforts, identify areas for improvement and make informed decisions to drive sustainable growth.

What Is Net Dollar Retention for SaaS Companies?

Net dollar retention, also known as net revenue retention (NRR) or net revenue expansion, is a metric used to measure the growth and revenue retention of a company’s existing customer base. It provides insight into the effectiveness of a company’s customer success and upselling strategies.

Net retention calculates the change in revenue generated from a cohort of customers over a specific period, typically on an annual basis. Net retention accounts for the revenue expansion from upsells, cross-sells and additional purchases made by existing customers, as well as the revenue contraction due to customer attrition and downgrades.

A value above 100% indicates revenue expansion, meaning the company’s existing customers are generating more revenue over time through additional purchases or upgraded subscriptions. A value below 100% suggests revenue contraction, indicating the lost revenue from customer attrition and downgrades outweighs the revenue gained from existing customers.

Net dollar retention is an important metric for subscription-based businesses, software-as-a-service companies and other businesses with a recurring revenue model. This rate helps assess the health and growth potential of a company’s customer base and provides insights into the effectiveness of customer retention and expansion strategies.

What Is Gross Retention for SaaS Companies?

Gross retention, also known as customer retention rate, is a metric that measures the percentage of customers a company retains over a specific period. This metric provides insight into the company’s ability to retain its customer base and indicates customer loyalty and satisfaction.

Gross retention is typically calculated on a monthly, quarterly or annual basis. Gross Retention is an essential metric for businesses, as it helps assess the effectiveness of customer acquisition and retention strategies. A high retention rate suggests customers are satisfied with the company’s products or services and are more likely to continue their relationship. A low retention rate may indicate issues with customer satisfaction, product quality or the competitive landscape that could impact the company’s long-term growth and profitability.

Net Retention vs. Gross Retention

Net retention and gross retention are two metrics used to measure customer retention for SaaS companies. While they both provide insights into the customer base, they focus on different aspects of retention and offer distinct perspectives on the overall health of a business’s customer relationships:

- Gross retention: The gross retention rate is a metric that measures the percentage of customers retained by a business over a specific period without considering any additional revenue generated from those customers. It provides a straightforward view of customer retention and indicates the ability to maintain the existing customer base. Gross retention rate is calculated by dividing the number of customers retained by the starting number of customers during the period, typically expressed as a percentage.

- Net retention: The net retention rate takes into account both customer retention and any expansion revenue generated from existing customers. It measures the overall growth potential within the existing customer base. Net retention rate considers additional revenue generated from upsells, cross-sells, upgrades or other expansion opportunities. This rate is calculated by taking the total revenue from existing customers at the end of a period and dividing it by the revenue from the same set of customers at the beginning of the period, typically expressed as a percentage.

The key differences between gross retention vs. net retention include:

- Revenue consideration: The gross retention rate solely focuses on the number of customers retained without considering any additional revenue generated from those customers. In contrast, the net retention rate takes into account the revenue generated from upsells or expansion within the existing customer base.

- Growth perspective: The gross retention rate reflects the ability to maintain the customer base, while the net retention rate provides insights into the growth potential within the existing customer base. Net retention considers the value derived from customer expansion activities and indicates the effectiveness of upselling and cross-selling efforts.

- Expansion revenue impact: The net retention rate captures the impact of additional revenue generated from existing customers, highlighting the contribution of customer retention strategies aimed at increasing customer lifetime value. The gross retention rate does not consider expansion revenue and focuses solely on customer retention.

- Evaluation of performance: The gross retention rate is a more straightforward metric that indicates the ability to retain customers, while the net retention rate provides a more nuanced evaluation of performance by considering both customer retention and expansion revenue.

Both metrics are valuable and can provide different insights into a business’s customer retention efforts. When assessing customer retention, you can analyze both metrics to gain a comprehensive understanding of your business’s performance and growth potential.

Net Retention Formula

To perform this calculation, use the net revenue retention formula:

Net retention rate = ((Revenue at the end of the period – revenue from churned customers) / revenue at the start of the period) x 100

To calculate the net retention rate, you need to determine the revenue at the start and end of a specific period and also consider the revenue lost from customers who churned, meaning they canceled or stopped using your products or services during that period.

Here’s a step-by-step breakdown of the formula:

- Determine the revenue at the start of the period: Identify the total revenue generated by all existing customers at the beginning of the period you are measuring, including revenue from both new and existing customers.

- Determine the revenue at the end of the period: Calculate the total revenue generated by the same set of existing customers at the end of the period you are measuring, including revenue from both renewals and expansion revenue from those customers.

- Calculate the revenue from churned customers: Identify the revenue generated by customers who churned during the period.

- Subtract the revenue from churned customers from the revenue at the end of the period: Deduct the revenue generated by churned customers from the total revenue at the end of the period.

- Divide the result by the revenue at the start of the period: After subtracting the churned customer revenue, divide the adjusted revenue by the revenue at the start of the period.

- Multiply the result by 100: Multiply the quotient by 100 to express the net retention rate as a percentage.

The resulting percentage indicates the net retention rate, which represents the growth and revenue contribution from existing customers, considering both retention and expansion.

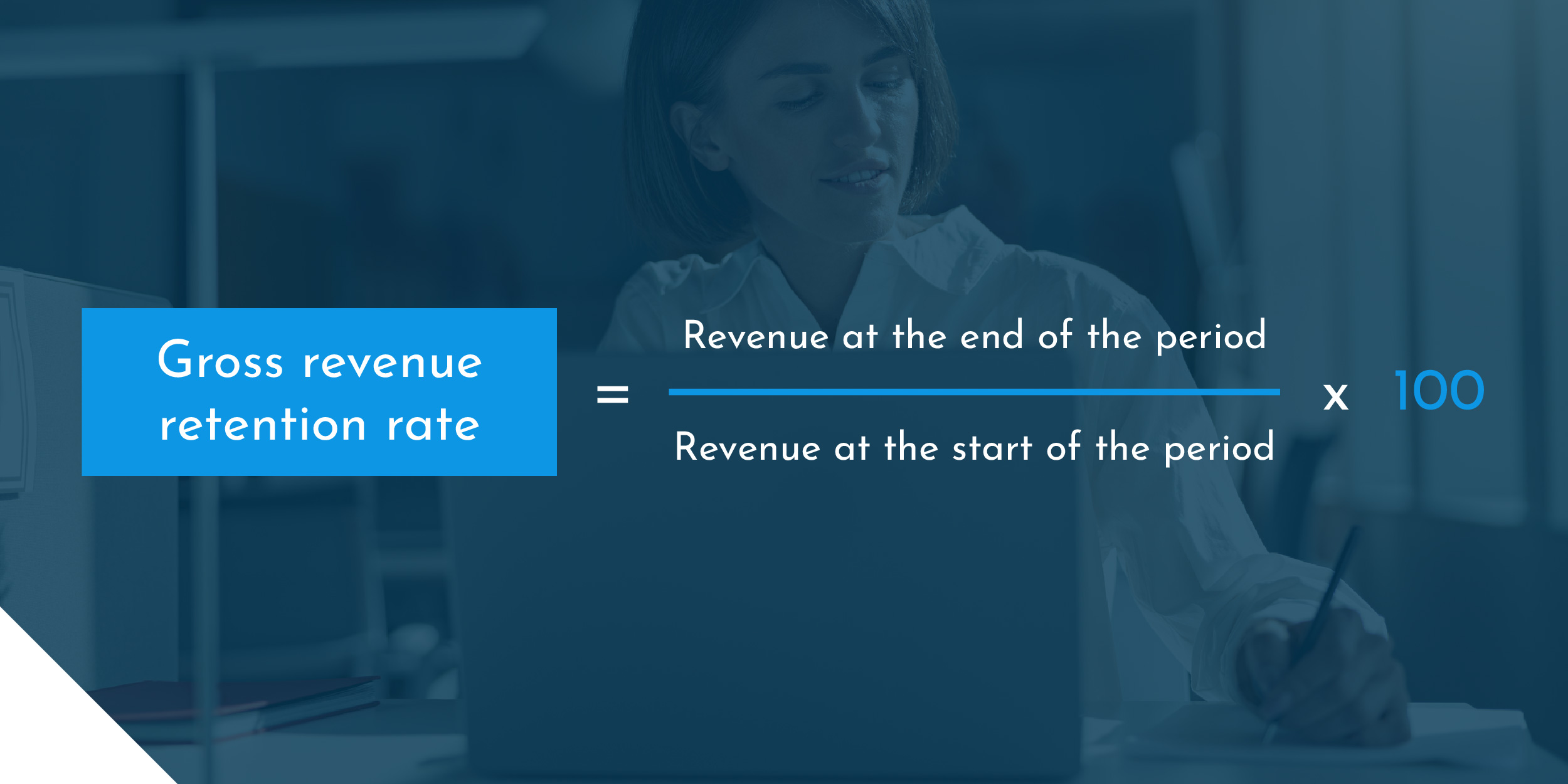

Gross Revenue Retention Formula

The gross revenue retention rate is calculated using the following formula:

Gross revenue retention rate = ((Revenue at the end of the period) / revenue at the start of the period) x 100

Here’s a step-by-step breakdown of the formula:

- Determine the revenue at the start of the period: Identify the total revenue generated by all customers at the beginning of the period you are measuring, including revenue from both new and existing customers.

- Determine the revenue at the end of the period: Calculate the total revenue generated by all customers at the end of the period you are measuring, including revenue from both renewals and expansion revenue from new and existing customers.

- Divide the revenue at the end of the period by the revenue at the start of the period: Divide the revenue at the end of the period by the revenue at the start of the period.

- Multiply the result by 100: Multiply the quotient by 100 to express the gross revenue retention rate as a percentage.

The resulting percentage indicates the gross revenue retention rate. A gross revenue retention rate of 100% indicates the business has retained all of its revenue from existing customers, while a rate below 100% suggests that the business has experienced some revenue loss from existing customers during the period.

How to Calculate Retention Rate

To calculate the retention rate, you need to determine the number of customers retained over a specific period compared to the number of customers at the beginning of that period. The resulting percentage represents the retention rate, which indicates the proportion of customers you were able to retain during the specified period.

For example, if you started with 500 customers and retained 450 customers at the end of the period, the calculation would be as follows:

Retention rate = (450 / 500) x 100 = 90%

This means you have a retention rate of 90%, indicating you retained 90% of your customer base during the period.

Calculating and monitoring the retention rate helps you evaluate the health and stability of your customer base and provides insights into customer satisfaction and the success of your efforts to retain and engage customers over time.

Why Does Your Net Revenue Retention Rate Matter?

The following are a few reasons why the net revenue retention rate matters:

- Revenue growth: The net revenue retention rate measures the growth or contraction of revenue from existing customers. A high rate indicates that existing customers are generating more revenue over time, and this revenue expansion from existing customers can be a significant driver of overall revenue growth for your company.

- Customer success and satisfaction: A high net revenue retention rate also suggests that customers find value in the product or service and are more likely to remain loyal. A high rate indicates your company’s customer success efforts, including onboarding, support and engagement, are effective in retaining and growing customer relationships. A low net revenue retention rate may indicate customer dissatisfaction or inadequate customer success strategies, requiring attention to improve customer retention and expansion.

- Cost efficiency: Gaining new customers can cost more money and time than retaining existing ones. A high net revenue retention rate means that your company can generate significant revenue without relying heavily on new customer acquisition efforts. This can result in better cost efficiency, as it is generally more cost-effective to retain and expand existing customers than constantly seek out new ones.

- Business valuation: The net revenue retention rate is an essential metric for investors and stakeholders evaluating the health and growth potential of a business. A high net revenue retention rate demonstrates a strong customer base and revenue retention, which can positively impact your company’s valuation and attractiveness to potential investors or acquirers.

- Churn management: Additionally, the net revenue retention rate provides insights into customer churn. By analyzing the net revenue retention rate, your business can identify areas of improvement to reduce churn and increase customer retention. This could involve addressing product issues, improving customer support, enhancing features or implementing customer feedback to ensure long-term customer satisfaction.

Challenges of Tracking Your Revenue Retention Rates

Tracking revenue retention rates can present certain challenges for SaaS businesses. Here are some common challenges associated with measuring and monitoring revenue retention rates:

- Data accuracy and consistency: Accurate and consistent data is crucial for calculating revenue retention rates. However, ensuring data quality can be challenging, especially when dealing with large volumes of customer data from various sources. Inaccurate or incomplete data can lead to misleading retention rate calculations.

- Data integration: Revenue retention rates require data from different systems and departments, including sales, customer service, billing and finance. Integrating data from these disparate sources can be complex and time-consuming, particularly if there are data silos or incompatible systems. Establishing proper data integration and synchronization processes is essential for accurate retention rate calculations.

- Churn definition and measurement: Defining and measuring churn can be challenging, as different companies may have varying definitions of what constitutes a churned customer. Some businesses consider a customer churned when they cancel their subscription, while others may also include customers who downgrade or reduce their usage. Consistency in defining and measuring churn is crucial for accurate retention rate calculations.

- Timeframe and cohort analysis: Determining the appropriate timeframe for measuring revenue retention rates can be tricky. Different businesses may choose different time intervals, such as monthly, quarterly or annually, based on their business model and customer lifecycle. Additionally, conducting cohort analysis, which involves tracking a specific group of customers over a set period, can add complexity to the retention rate calculations.

- Revenue attribution: Properly attributing revenue to different customer cohorts or segments can also be challenging. For example, if a customer upgrades their subscription, determining how much of that increased revenue should be attributed to retention versus expansion can be difficult.

- External factors: Revenue retention rates can be influenced by external factors, such as market conditions, competition or changes in customer preferences, which can make it challenging to isolate the impact of internal factors like customer success initiatives on retention rates.

To overcome these challenges, your business should invest in robust data management systems, establish clear definitions and methodologies for calculating retention rates and regularly review and validate data accuracy. You can also leverage advanced analytics and reporting tools to automate data integration, perform cohort analysis and gain deeper insights into retention trends and drivers.

Contact Us at Compass East

Net retention rate and gross retention rate are valuable metrics that provide insights into your business’s customer retention efforts and growth potential. By understanding the differences, calculations and implications of these metrics, your business can develop targeted strategies to improve customer retention, enhance customer relationships and foster sustainable growth. Monitoring and benchmarking retention rates, coupled with effective retention strategies, can empower your business to build a loyal customer base and drive long-term success in today’s competitive landscape.

At Compass East, our team provides a finance and accounting solution for high-growth businesses. We develop a scalable financial operation through the technology implementation and a full finance and accounting team, along with dynamic reporting needed to offer financial and growth strategies for your business. Contact us at Compass East today to learn more and set up a free consultation.