Defining Financial Projections and Modeling | What Would You Use a Financial Model For? | Connecting the Vision to the Financial Model | Questions the Financial Model Can Answer | Telling Your Financial Story Through a Pitch Deck | Systemize Forecasting With Jirav Pro | Financial Modeling Best Practices

So far, we’ve focused on what you can do to build your finance and accounting (F&A) team, create a clean Chart of Accounts and build lagging key performance indicators (KPIs). Establishing your company’s F&A infrastructure gives you the necessary systems and processes to rely on good data.

Once you have those processes and infrastructure in place and have the data you need, you can start to tell the truth of your business’s financial story and health.

Your company’s true financial story lies somewhere between the operator’s vision for it and what’s real and objective. Projection modeling helps you establish that story and allows you to measure the gap between where your business is today and where you want it to be in the near future.

Defining Financial Projections and Modeling

First, let’s define what a financial model is. It’s a tool, usually built using historical data and spreadsheets, that forecasts your company’s financial performance.

To build a financial model, you typically rely on data from your company’s past performance and assumptions about the future. To put together a financial model, you need a balance sheet, cash flow statement, income statement, and other supporting documents. Once you have the basic financial model down, models can be created to address specific strategic decisions, such as leveraged-buyout projections, discounted cash flow analysis and sensitivity analysis.

Don’t confuse KPIs, cash forecasts, budget and financial statements with a financial model, as each one serves a different purpose. Understanding the differences between KPIs, cash forecasts, budgets, financial statements and financial modeling is a crucial step.

KPIs

As we discussed in Chapter 6, KPIs, specifically lagging KPIs, measure historical indicators. They let you define and understand the underlying business drivers.

You can develop KPIs into benchmarks that you track and hone over time. After establishing measurable KPIs, you can use them as the levers and initial inputs for your long-term financial model.

Budgets

Many businesses develop an annual budget to project expenses and income over the coming year. Depending on your company’s preference, your budget can cover the fiscal year or calendar year. Budgets often include projected expenses, cash flow statements and balance sheets.

The goal of creating a budget is often to predict spending needs and track variance to the plan. If your company has more expenses than income, a deficit builds. When you have more income than expenses, you have a surplus.

Your budget is more static than other financial metrics. You might revisit it monthly to see how reality compared to what you projected. With your budget, you can make decisions that directly impact the growth trajectory of your business. Your company’s financial model plays a part in establishing its budget.

Cash Forecasting

Cash forecasting measures how much cash flows into and out of your business during a specific period, based on business spending and short-term prospects. Most cash forecasts are built for 30, 60 or 90-day cycles. They get updated frequently to allow your company to make key decisions and ensure you have an appropriate amount of cash and runway left to keep the business operational.

Financial Statements

There are three types of financial statements: the cash flow statement, the balance sheet and the profit and loss (P&L) statement, also known as the income statement.

The cash flow statement shows how your company exchanges money with the broader world during a defined period. The balance sheet reveals what your business owes and what it owns during a specific period. Finally, the P&L or income statement indicates the amount your business has earned and spent during a particular period.

Each financial statement is based on historical data but provides the base for your company’s financial models. You can create a three statement financial model to make financial projections about your company in each statement area.

KPIs, budgets, cash forecasting and financial statements aren’t financial models on their own. Instead, you can think of them as the ingredients to build an effective model.

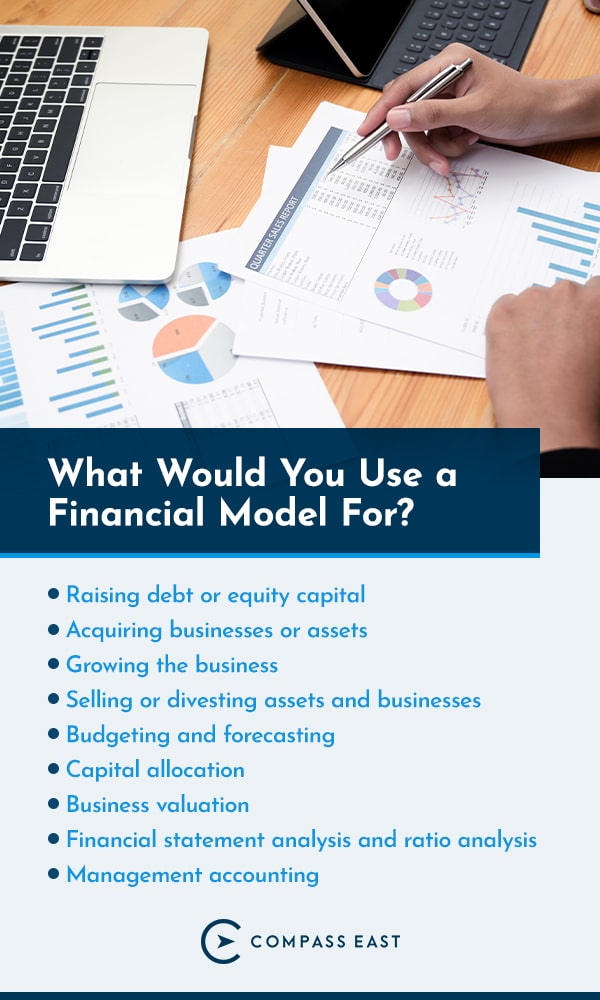

What Would You Use a Financial Model For?

Companies use financial models to make decisions or perform internal or external financial analyses. Applications for a financial model include:

- Raising debt or equity capital: If your business wants to get investment funding or loans, it will most likely need to provide the investor or financial institution with a financial model that displays stability and the potential for ongoing revenue and growth. Your financial model should be incorporated into your pitch deck and include your budget and cash forecast.

- Acquiring businesses or assets: A financial model can help you determine if acquiring another business or purchasing new assets makes sense for your company at the moment.

- Growing the business: Organic business growth can involve opening new stores or moving into new markets. Before your company can grow, it needs to be confident it has the financial strength and backbone to do so.

- Selling or divesting assets and businesses: It might be the case that selling your business or certain assets is the most cost-effective option or the option that makes the most sense for your company at a particular point in time. Your financial model can help you determine the best course of action to take.

- Budgeting and forecasting: Although your company’s budget should be part of its financial model, the model you build can also help you create budgets in the future. Budgeting models give you a better sense of your company’s performance and can help you make future decisions.

- Capital allocation: How to spend the company’s money is often the big question businesses have. With a financial model, you can compare and contrast the effects of your business’s financial health if you put your company’s capital in one area or another.

- Business valuation: If your goal is to go public, running financial models is one of the ways bankers can determine how much your company is worth. A financial model leads to an initial stock price. You might also want to value your business if you plan on selling soon. Knowing your company’s worth lets you take steps to increase its value so you get the best price when the time comes to sell.

- Financial statement analysis and ratio analysis: A financial model provides the backbone you need to analyze your company’s financial statements.

- Management accounting: You can use the financial model to support your business’s management accounting process. Management accounting helps your company’s leaders make crucial decisions about the company’s future and growth.

No matter your company’s overall goals, long-term projection modeling lays the groundwork to help you achieve them.

Connecting the Vision to the Financial Model

Your company’s financial model can say anything you want. That can create a disconnect between the financial model and your business’s overall vision. There can also be a disconnect between the model and the reality your company exists in.

For that reason, you need to build a model that’s based on reality. You also need to test the financial model to make sure it holds up.

Use Historical Data, Key Drivers and Current Budgets

To create a model that will pass the reality test, it’s essential to use historical data, which you can draw from your financial statements, average price points, average contract values and customer pipelines. When building your model, you can also use your business’s key drivers, which you get from the KPI dashboard. Finally, your company’s current budgets and expenses can also provide the relevant data you need to create a realistic financial model that bridges the gap between your company’s vision and reality.

Give Your Financial Model a Purpose

Along with using your company’s historical data, it’s essential to create a purpose for your financial model. Think of where you expect the company to be in one quarter, one year or several years. Then, consider any problems that might stand in your way or keep you from reaching your company’s goal.

For example, you want to increase your company’s revenue by 20% over the next year so that you grow to a $2 million company. That’s your vision and goal. Now you need to build a model that shows you how to get there.

Chart the Best Path Forward With Estimates

Use your historical data to base your model in reality, then try out a few estimates to plot the best path forward. One option is to estimate the number of new customers your business might get that would drive your revenue up. To arrive at the estimate, you can examine your current typical sales cycles to see when there are the most sales or influx of purchases.

Consider Labor Productivity

It also helps to examine labor productivity. How much revenue does each employee currently generate, and how much could they potentially generate? Next, consider if hiring more people would lead to an increase in revenue that’s enough to make up the difference in the cost of hiring new people. Then, use your data to determine how much outside capital you need and what type of cash flow is necessary until you have enough new customers to be profitable and reach your goals.

Adjust Your Company’s Goals As Needed

Your financial model can pull you back down to reality if necessary and help you access outside capital. A financial model reveals your business model’s viability by showing whether what you hope to achieve will work. You might project $100 million in sales based on activity during your first five years in business, in a $200 million market, in this case, you would be projecting owning 50% of the market in the first five years, which is generally unrealistic. Rather than taking a top-down approach to financial modeling, use realistic baselines to create a bottom-up model. For example, if based on historical data you know your sales team can close 10 deals a month at $10,000 per annual average contract, you would be estimating generating about $100,000 of new sales per month (a very simplified example). Theoretically, this would be $1.2 million of revenue in year one which would be a more realistic projection. From that baseline projection, you can start to add test variables like adding salespeople, raising or lowering close rates based on historical data, measuring implications of price increases, or investing in marketing activities to drive more leads.

Depending on your goals, you can get very complex when building a financial model. There is obviously the expense side of the model that starts to project the need the cost implications of new hires and the need to raise capital or grow organically. A more complex model might fully illuminate your cash flow based on how quickly you collect on accounts receivable or provides the most accurate insight into purchasing equipment or building new buildings.

Financial models help scope the viability of the business model. Your model will test that vision based on market viability. From there, you can develop a new projection that’s more in line with reality and that is more likely to get you the outside funding you need to grow your business.

Questions the Financial Model Can Answer

A financial model can answer several questions for your company. Once you’ve built the larger model, you can modify it for use in specific scenarios.

- What are the impacts of upside and downside scenarios? Scenario analysis lets you examine and evaluate potential situations. You can predict the results or outcomes of these situations with a financial model. Often, you can estimate changes to your company’s cash flow or value using best-case (upside) or worst-case (downside) scenarios.

- Should your business raise capital? A financial model can answer whether your company is in a position to raise capital at the moment. If so, you can determine what type of capital, such as lender or investment, is most appropriate.

- What will happen if you add additional business lines or enter new markets? Using a financial model, you can evaluate the impact of adding a new product line to your offerings or trying to enter new markets. You can predict how long it will take for your company to become profitable or if the idea is worth pursuing at all.

- Can you expand locations and what’s the cost of doing so? Similarly, a financial model can help you determine the cost of expanding and if expansion is feasible at the moment or in the near future.

- How should you time new hires? You can use a financial model to decide when to hire new team members. Based on the data from the model, you can also see how quickly new hires will be able to contribute to your company financially.

You can also build a financial model to answer a question that’s unique to your company.

Telling Your Financial Story Through a Pitch Deck

A pitch deck lets you tell your company’s story while winning over investors. A financial model should form the backbone of your pitch deck. Your company’s projections and financial growth story will be the key to getting investors interested and convincing them to fund your company.

Your pitch deck should contain the following elements, and each of these elements should be influenced by your company’s historical data and financial model:

- Company vision

- Business model

- Value proposition

- Market opportunities

- Business Model

- Team

- Competitors

- Customers / Traction

- Your growth plan

- Fundraising Plan

- Financial information, including budget and cash flow

Building a financial model before fundraising also gives you a clear idea of how much money you need to raise. If not, you’re taking a shot in the dark without a strong financial backbone. The one thing that is almost always true about a financial model is that it will be wrong. With that understanding, however, projections need to be based in reality to truly guide business growth and use of funds. To get the attention and financing of an investor, your pitch deck needs to be engaging and financially accurate.

A financial model also gives you an idea of how much equity to offer investors in exchange for their capital. Your models should drive your decision based on what your company needs to grow.

Your financial model should match what you say in your pitch deck. It provides the assumptions you can use to match your vision and ensure it’s based in reality.

Systemize Forecasting With Jirav Pro Forecasting

You have multiple options for building a financial model. Software programs help streamline and systemize the process. At Compass East, we use Jirav Pro Forecasting to systemize forecasting for our clients and ensure that our clients’ models are actionable, nimble and updated for usability.

Benefits of using Jirav include:

- Pre-built templates and formulas let you create driver-based financial models quickly.

- Update models automatically with actual numbers after connecting the system to your accounting system.

- Integrate cash flow forecasting to predict runway up to 60 months in the future.

- Easily roll your financial forecast forward each month.

- Revenue projection based on metrics you define.

- Create budgets by department.

- Model expenditures based on financial statements.

- Perform what-if analyses to change assumptions quickly.

Financial Modeling Best Practices

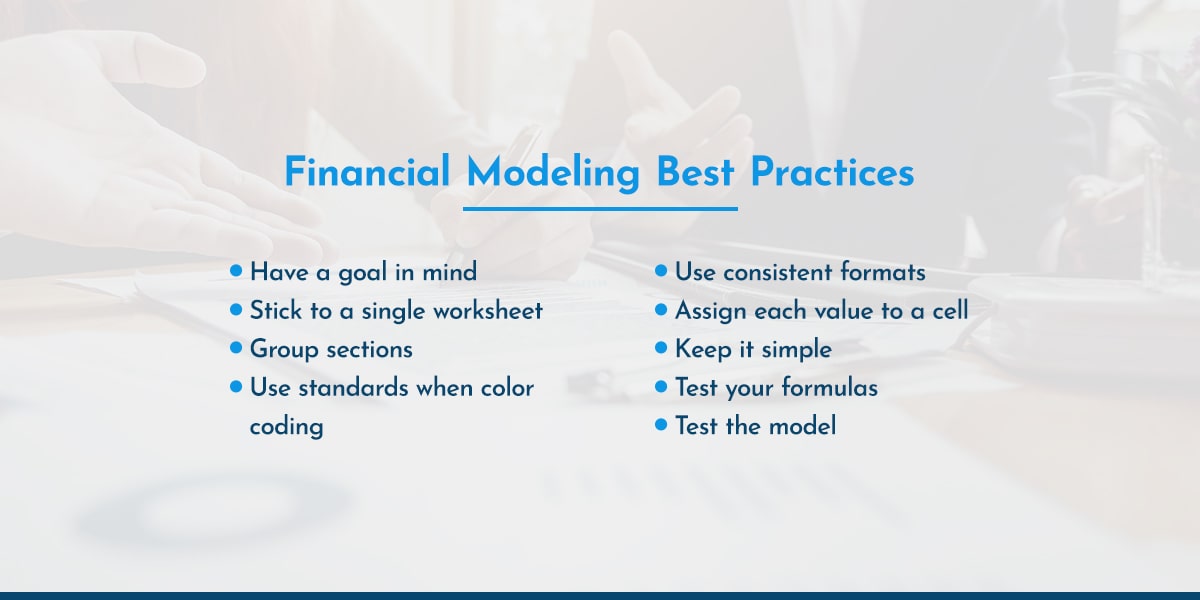

While every financial model is slightly different and unique to the company that creates it, there are some general formatting requirements, industry expectations to meet and best practices to follow when building a model.

The goal is to create an accurate model that’s easy to read, and that’s flexible enough to bend to the complexity of the task at hand. It’s also vital that the model matches the application. Not following best practices can lead to misinterpretation of your company’s financials or cause an investor to pass your company over.

For the best results and most effective financial model, follow these best practices:

- Have a goal in mind: Know why you’re creating the financial model in the first place. That means you should clearly understand the problem you want to solve. You should also know who the intended audience is for the model.

- Group sections: Make your financial model clear and understandable by sorting sections into groups. For example, begin the model with your assumptions, then move on to your balance sheet and income statement. Make sure it’s easy to differentiate between each section or group in the model.

- Use standards when color coding: There are standards to follow for color-coding. Your formulas should be in black, and assumptions should be in blue. Use red for links to other files and green when linking to other worksheets.

- Use consistent formats: Pick a format for your numbers and stick with it throughout the model to avoid confusion. For example, you can use either a negative sign to show negative values or parentheses, but not both. Once you’ve decided on a color to use, stick with it throughout the model. Depending on your program, you can customize the spreadsheet to keep your formats consistent.

- Assign each value to a cell: Every value should have its own cell and only be on the worksheet once to minimize errors and keep the model easy to read. Don’t embed assumptions into formulas. It can affect the accuracy later on if you have to make adjustments.

- Keep it simple: Aim for simplicity at all times. If your formulas are complex, break them down into multiples.

- Test your formulas: Your results are only as good as the data you put in, so make sure you test and double-check your numbers often. Also, test your formulas to make sure they are correct.

- Test the model: Try to break your model by running several scenarios. Identifying the model’s weak points allows you to refine things. It also helps you better understand what you’re building.

Let Compass East Help You Tell Your Financial Vision Story

Compass East’s financial modeling services help you craft your company’s financial vision and story. We work with you to help develop a budget, understand your business performance, make a growth plan and minimize risk.

We’re experts at working with high-growth businesses, helping them streamline financial management and get to the heart of their company. If you’re ready to take your company to the next phase of growth but aren’t sure how to manage the financial aspects on your own, we’re here for you. Contact us today to learn more.