What Are KPIs? | Product-Market Fit | Team-Market Fit | Product-Team Fit | KPI Glossary

Your company needs accurate data and well-defined company drivers to make critical strategic decisions. Key performance indicators (KPIs) give you the data you need to make informed decisions, resulting in faster growth and more predictable results. Think of your KPIs as the health dashboard for your company. They show you how your business is doing and where there’s room for improvement.

In previous chapters, we discussed how to build your F&A team, implement technology to scale finance and accounting function, and the importance of a clean Chart of Accounts structure, financial reports and data. If these activities are the “inputs” of your financial operations, KPIs are the “outputs.”

You can benchmark and track KPIs over time to inform everything from your hiring schedule to your quarterly goals. We focused heavily on the Chart of Accounts and structured reporting in the previous chapter because, without the steady foundation for your books, it’s impossible to develop accurate KPIs.

What Are KPIs?

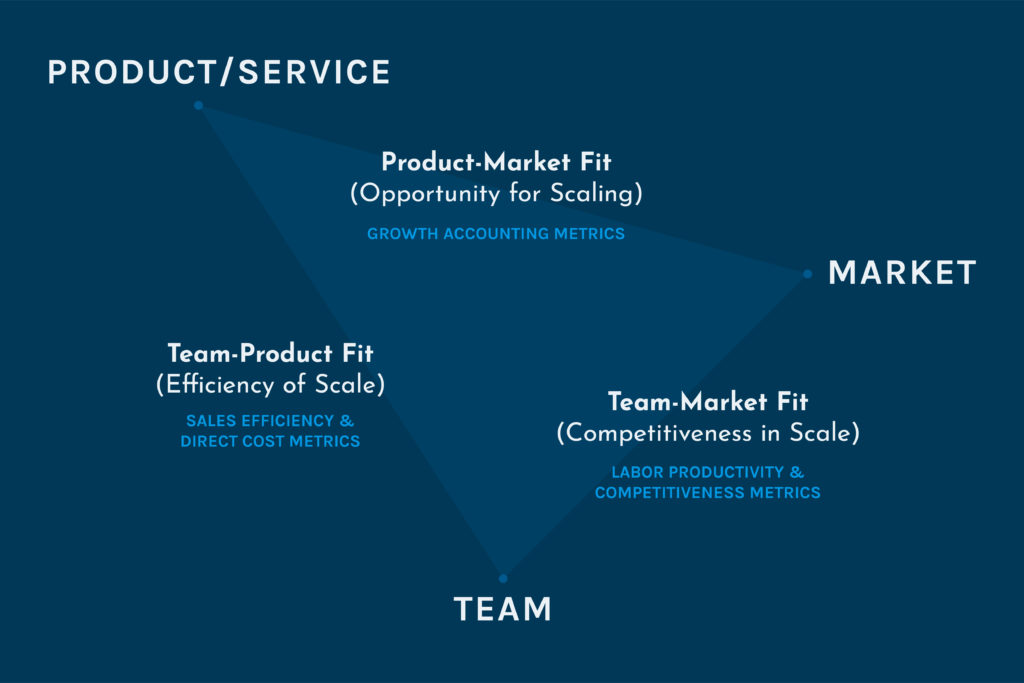

The technology industry has been at the forefront of developing smart metrics for managing growth of their organization. Tribe Capital, a $1.6B venture fund investing in data science companies developed an insightful deep dive into their data-focused approach to growth metrics. In their essay, “A Quantitative Approach to Product-Market Fit”, the team at Tribe Capital discusses the details of Growth Accounting Metrics that are essential to managing Product-Market Fit. We loved the detailed dive so much, that at Compass East, we took it a step further to curate the KPIs that are necessary when evaluating not just Product-Market Fit, but Team-Market Fit and Team-Product Fit as well. In any business, it will be the aggregate of these elements that will make your business scalable, competitive, and sustainable in an ever-changing world.

During this chapter, we’ll focus on “lagging” KPIs, which you define based on things that have already happened (“historicals”). They’re the result that ultimately your leading indicators (activities) should predict. They’re developed using your closed monthly financials, which is why it is imperative to close your books monthly. With a delay in closing the books, your KPIs and information will be dated or inaccurate.

KPIs fall into three primary categories or buckets:

- Product-market fit

- Product-team fit

- Team-market fit

Your KPIs should inform all aspects of your business. In the following chapter, we’ll develop growth accounting metrics, sales efficiency and direct costs metrics, and labor productivity numbers and competitive metrics.

Product-Market Fit

Product-market fit refers to how well your company’s product serves the market. When you have a good product-market fit, there’s demand for what your company sells. In some cases, driving product-market fit means adapting what you sell to your customers’ needs.

Several KPIs can give you an idea of how well your product serves the market and if there’s an opportunity for growth:

- Revenue growth: You can track revenue growth month over month or year over year. Ideally, it will have grown over the past year. You can use year-over-year growth to figure out your trailing 12-month growth rates over time. Is there an upward trajectory, or did your revenue hit a peak, then start to plateau or drop?

- Churn rate: How well are you keeping customers? Any business can benefit from measuring churn rate, whether subscription-based or not. If you previously had 100 customers per month, do you still have 100 per month? Or is it now 90 or 110 customers? How many customers are repeat customers?

- Debt: In the early stages, many businesses in growth mode use debt to help drive revenue growth. Comparing your debt to your revenues allows you to see if the debt is helping drive your company’s growth.

Team-Market Fit

Another thing to consider is how well your team is serving the market and whether it can scale with the market. One KPI to examine to evaluate team-market fit is your labor productivity. You can determine labor productivity in several ways:

- Revenue per employee

- Gross margin per employee

- Labor efficiency ratio

- Realization and utilization rates

You can also examine how competitive your company is and what amount of purchasing power it has to evaluate team-market fit.

Labor Productivity

When evaluating labor productivity, consider how many dollars your company brings in for every dollar it spends on the payroll. Ideally, your team will bring in enough revenue to earn a profit. Labor productivity is a relatively simple KPI to track. You can look at revenue per employee and gross margin per employee across multiple business models to determine how effectively your team brings in a profit.

Realization and utilization rates also help you track labor productivity. If you have a service-based business that delivers revenue to a customer, how much of your team’s time is spent on a chargeable project or a client matter at all? How much time is your team spending on administrative tasks? You want your team to spend more time on client matters to keep your numbers as high as possible.

Competitiveness Score

One of the first factors to measure when determining your team’s competitiveness is productivity growth. In this example, let’s use revenue per employee as our measure of productivity.

In June 2021, your revenue per employee was $100,000, and in June 2020, it was $50,000. During that trailing 12 month period, you’ve had essentially 100% productivity growth. To determine competitiveness, we also have to look at wage growth during that period.

From June 2020 to June 2021, your revenue per employee went up 100%. Ideally, wages wouldn’t grow faster than productivity. So if during that same period, wages went from $50,000 to $150,000, they grew by 200%.

When productivity is 100%, but wages are 200%, that’s not a good sign. But, let’s say wages went from $50,000 to $75,000. That’s a 50% increase, and productivity went up by 100%. You’re still in good shape.

Purchasing Power

Your company’s purchasing power refers to how your fixed operating expenses compare to your total sales. Fixed operating expenses include office supplies, rent, utilities, insurance, overhead and professional services, like legal and accountants and IT consultants.

Ideally, the ratio of your costs to your sales will decrease over time. As your business continues to grow and expand its top line, the percentage of your sales that you spend on expenses should become smaller. As that number shrinks, your purchase power grows. That increased purchase power can become opportunity capital, where you can save and target capital for scaling opportunities.

Product-Team Fit

Product-team fit refers to how well your team suits the product your business sells. Quite simply, do you have a team that can effectively market and deliver your product and service?

To evaluate product-team or team-product fit, we can take a quantitative approach. Now’s the time to talk about efficiencies in your scale, such as your sales efficiency and direct cost metrics. For example, can your team provide this appropriately?

Sales Efficiency

Sales efficiency is how much revenue your company produces for every dollar you spend on advertising and marketing. When tracking sales efficiency, two metrics to keep in mind are the customer acquisition cost (CAC) and lifetime value (LTV).

To calculate CAC, divide the cost of marketing and sales by the number of new customers your company gets. The lower your CAC, the better.

CAC goes hand in hand with LTV. LTV refers to the value of sales a particular customer will bring in throughout their lifetime or the length of their relationship with your organization. LTV also lets you evaluate how well your team serves the product and how well your product serves the market. If the LTV is low, it could be that your team isn’t providing the best service possible or that your product no longer fits the market’s needs.

Direct Costs Efficiency

Your direct costs efficiency includes metrics that compare your direct labor costs to sales and your gross margin percentage. It also examines your purchasing power.

When evaluating direct costs efficiency, your target is the essential thing to look at. Specifically, is your company growing or declining? For example, when looking at your direct labor costs as a percentage of sales, ideally, your prices keep up with increases in labor costs. You should have the right people on your team to deliver your product efficiently.

Purchasing power growth of direct materials refers to the percentage of revenue you spend on materials. It should trend downward or stay the same over time. For example, consider you’re in a landscaping business, and direct materials to service a job is 20%. If, over time, that 20% creeps toward 25% or 30%, something might be going on in the market.

Your options are to increase your prices or explore other ways to increase your purchasing power, such as improving efficiency or finding a source for lower-priced materials.

KPI Glossary

Now that we’ve discussed the three main categories for KPIs, let’s zero in on the meaning of specific metrics. We’ve divided the glossary into categories to help you see what terms fit where.

Revenue Growth Metrics

To track revenue growth, you’ll need to know the following:

- Monthly revenue: Knowing your monthly revenue is the foremost and most simple metrics to track. Additionally, knowing the trends and seasonality in this metric is very important. The total will equal the sum of the displayed period.

- Trailing 12 month (TTM) revenue: Knowing TTM revenue allows you to know your annual revenue runway. TTM revenue is an essential number for many other metrics, too. The total will equal the most recent month’s TTM revenue.

- Month over month growth rate (MoM growth %): MoM growth calculates the change in monthly revenue from one month to the next. The total will display the average of the displayed period.

- Year over year growth rate (YoY Growth %): YoY growth displays the change in monthly revenue from the same month in the previous calendar or fiscal year. For example, you can calculate the difference between January 2019 and January 2020. The total will show the average of the displayed period.

- Annualized growth percentage: This compares the revenue growth rate of the most recent TTM revenue over that prior TTM revenue. For example, it can compare July 2019 to June 2020 and July 2018 to June 2019. The total will equal the rate for the most recent period.

- Sales and marketing percentage of revenue: This shows the percentage of revenue used in sales and marketing spend during the current period. The total will show the average of the displayed period.

- Sales and marketing TTM: This metric shows total sales and marketing spend over the trailing 12 months. This is important for many other metrics, as well. The total will equal the most recent period’s value.

- Sales and marketing percentage of revenue TTM: Compare the total sales and marketing TTM compared to TTM revenue with this metric. Overall, this will provide a better representation of the amount you spend on sales and marketing as a percentage of revenue while adjusting for seasonality and variations in revenue throughout the year. The total will equal the most recent period’s value.

- Defense interval ratio: This metric shows how many days your business can function without needing external financial resources or your noncurrent assets. It’s calculated by taking cash plus your accounts receivable that you have on your books and dividing the result by average daily expenses.

Direct Costs Performance Metrics

Metrics used to evaluate direct costs include:

- Direct labor percentage of sales: This is the percentage of monthly revenue spent on your direct wages and labor in the current period. The total displays the average of the reported period.

- Direct materials percentage of sales: This is the percentage of monthly revenue spent on your direct materials and job costs in the current period. The total shows the average of the reported period.

- Cost of goods sold (COGS) percentage of sales: This combines COGS percentage of revenue for the month. The total column will provide the average of the displayed period.

- Gross margin percentage of sales: This is the direct margin for the current period on the revenue generated. The total will display the average of the reported period.

- TTM gross margin percent: See the gross margin rate for the trailing 12 months with this metric. It divides TTM gross margin dollars by the TTM revenue. It’s the best measure of your gross margin rate as it will provide enough time to show aggregated data. Oftentimes, small businesses will have various items that make gross margin fluctuate from period to period based on accounting practices and entries.

Labor Efficiency Metrics

Some metrics you can use to evaluate labor efficiency include:

- Direct labor efficiency ratio (dLER): dLER tells you the amount of gross margin dollars generated for every direct labor dollar spent. It divides gross margin by direct labor. The metric will help show how efficient your direct labor force is performing against the revenue of the period. The total will display the average of the reported period.

- Management labor efficiency ratio (mLER): mLER tells you the amount of gross margin dollars generated for every management labor or operating expense labor dollar spent. It divides gross margin by management labor. This metric will show how efficient your management labor or corporate overhead team is performing against the revenue of the period. The total will display the average of the reported period. If there are any zeros returned, the total will be zero, as well.

- Overall labor efficiency ratio (LER): LER tells you gross margin dollars generated for every labor dollar spent. It divides gross margin by total labor. The metric shows how efficient your entire workforce is performing against the revenue of the period. The total will display the average of the reported period. An LER over 3.0 is typically a healthy value for most businesses. The objective is to continue to increase this value for the productivity of the business.

- Revenue per employee (revenue/EE): The revenue/EE metric provides the current month’s revenue divided by the total headcount for the period. The total will provide the average of the reported period.

- Revenue/EE annualized: The revenue/EE annualized metric multiplies the revenue/EE by 12. It provides an annualized metric for your current productivity and is the basis for later productivity metrics shown. It is important to show that productivity in small businesses can change quickly as management makes swift changes to their business model. The total column will display the most recent period’s value.

Sales Efficiency Metrics

Metrics to use when calculating sales efficiency include:

- S&M costs: This is the total TTM sales and marketing costs, which will show the most recent period’s value

- Clients: This is the number of unique clients in your business over the trailing 12 months. The total will display the most recent period’s value.

- Customer acquisition cost (CAC): How much money it costs your business to acquire one customer is your CAC. It is the TTM S&M Costs divided by the TTM unique customers. The total will display the most recent period’s value.

- Average customer revenue: Calculate the average amount brought in per unique customer with the revenue TTM divided by the TTM clients.

- Gross margin: Gross margin is sales minus the COGS.

- Customer lifetime value (LTV): For non-recurring revenue business, the LTV is simply the average customer revenue times TTM gross margin. If it is a recurring revenue business, the LTV will be determined by multiplying the MRR by the average customer life or term by the TTM gross margin.

- LTV/CAC: LTV divided by the CAC shows the amount of lifetime value from your customers over the customer acquisition cost. Or, it’s the amount of times the customer pays back your customer acquisition cost over their life. A ratio of 3.0 or higher is typically a healthy value. Larger numbers indicate efficient sales processes. If growth is the goal, you need to re-evaluate your spend to determine opportunities to take a little added risk in S&M to drive more revenue.

Estimated Taxes

Tax metrics to know include:

- Net Income YTD: This is how much income your company has earned through the year-to-date period.

- Estimated tax rate: This is a constant tax rate used to estimate taxes. For conservatism, we use 35% as a blanket top-level rate for most.

- Estimate tax due YTD: Refers to net income YTD times the estimated tax rate — for example, 35%. Assuming no other tax strategies are utilized, this would be the flat tax due. It is a conservative number to show what you may want to put away in savings to pay for taxes.

Compass East Can Help You Find Your North Star Metric

Now that you know the basics of KPIs, it’s time to find the metrics that matter most for your company. Compass East can help. We’ll work with you to help you discover your North Star metric, which will always help your company, no matter where you are in your growth process. To learn more, contact us today.